In this article

It’s well-documented that managed portfolios provide a range of benefits for both clients and advice practices. In addition to driving practice management efficiencies, they also provide a means to deliver a cost-effective value proposition and a better client experience.

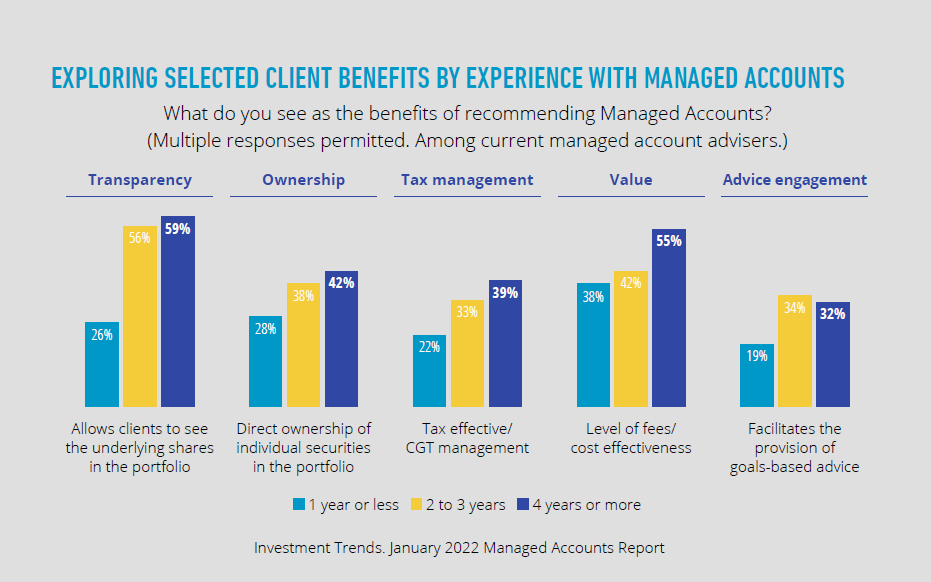

However, when comparing advisers’ perception of these benefits against the length of time they have used managed portfolios, an interesting trend begins to emerge – the longer an advice business uses managed portfolios, the higher their conviction in the client benefits they offer.

A recent investment Trends Report revealed that 26% of advisers who have used managed portfolios for less than a year recognised the benefits of enhanced transparency.1 This number increased to 59% for businesses that had been using managed portfolios for four years or more.

Similarly, while 38% of new-to-managed portfolio respondents noted that cost-effectiveness was a benefit, the number increased to 55% for businesses that had been using managed portfolios for four years or more. The story is the same for tax effectiveness: 22% to 39%.

So why do the client benefits of managed portfolios seem more apparent the longer you’ve been using them in your practice? And what’s the secret to getting the most out of managed portfolios? For two experienced practice owners, it’s about transparency, commitment and engagement with your clients.

Efficient base for future growth

Tim Scott, Director of Hobart-based advice business Ford + Scott Financial Planning, said his team started using managed portfolios in 2014. But it was only after they refined their investment philosophy and portfolio construction in 2018 that the operational efficiencies began to ramp up.

“The use of managed portfolios and SMAs, using a technology platform, allowed us to embed our philosophy more efficiently,” Scott said. “For us, implementation was a 12-month process. But once that process was over, it gave us huge traction with our clients and enabled us to heavily grow the business. We’re about to expand from four advisers to nine, and that’s on the back of the operational efficiencies that managed portfolios have created for us.”

Tim Townsend is a Founder and Partner at the Melbourne-based private wealth firm TownsendCobain. Around five years ago, Tim and his partner decided to start using managed portfolios once they became comfortable with the technology and how it could work for their clients. He believes the key to success with managed portfolios is committing to it completely.

“I often meet advisers who introduce new concepts, like managed portfolios, but they’re balancing it with five other things and then wondering why it isn’t as efficient as they thought it would be,” Townsend said. “We have a fundamental belief that our efficiency is also in the interests of our clients. After strengthening our investment solution, we presented it to our clients over an 18-month period. It was a serious commitment of work resources and effort to make these transitions, but now we’ve implemented managed portfolios for almost 100% of our clients. This has created a fantastic base for our future growth.”

Effective and empowered portfolio management

For both advisers, compliance constraints and ineffectiveness of the traditional advice model contributed to their decision to move to managed portfolios.

“With a traditional advice model, you can’t always implement investment changes quickly for each individual client,” Townsend said. What appealed to us was being able to carry all our clients forward in a positive way.”

Scott agreed with this and added that Ford + Scott’s decision to move to managed portfolios also provided opportunity for scale and a more efficient approach to portfolio management.

“We had a heavy direct equity exposure in our client portfolios and the volume of ROAs needed to achieve a portfolio change stifled efficiency,” Scott said.

Having a structure in place that creates efficiency but also transparency and communication has led to a huge amount of trust and client engagement.

Transparency, engagement and value

Townsend explained that the transparency that comes with managed portfolios gives clients a greater sense of ownership. And when their adviser is empowered to make portfolio changes on their behalf, it increases the client’s perception of the value they’re receiving.

“We do just as much work as we used to do on our clients’ investments,” Townsend said. “But now they’re hearing from us regularly, every time we make a change, and their peace of mind seems to be enhanced by the feeling that something’s being done. That enhances the perception of value to the client.”

Scott added that this increased perception of value has allowed his business to strengthen their client/adviser relationships.

“We’re finding that client interactions are now much less focused on how their portfolio is going and more about their goals and objectives,” Scott said. “It’s more outcomes-based, which is allowing our advisers to have far more meaningful conversations with their clients.”

Both advisers stressed the importance of regular communication to ensure clients recognise the value of their managed portfolio.

“Your managed portfolio provider can send you a couple of paragraphs about the trade that’s been made and why it’s been made,” Scott said. “You can then put that on your letterhead and disseminate it to your clients who hold those investments. It’s incredibly powerful for the client because it gives them that sense of ownership, tangibility and control.”

Embracing and committing to managed portfolios

Transitioning clients to managed portfolios can take a significant amount of time of effort. But like so many things in business, you get out as much as you put in. As the Investment Trends research shows us, the key to unlocking the efficiency of managed portfolios is fully embracing the technology and sticking with it over time.¹

“You back yourself and you see it through,” Scott said. “Clients are more open to change than you may well think. They love seeing proactivity. They want to see progression and their adviser planning for their future, not just for today. There’s huge scope and opportunity for advice practices that are willing to move with the times right now.”

Townsend emphasised there’s no need for hesitation when introducing the concept of managed portfolios to clients.

“You don’t have to apologise for not doing it yesterday,” Townsend said.

Our clients expect us to be learning, finding, developing all the time to find better solutions for how we do things.

1Investment Trends, Managed Accounts Report, January 2022.