By collaborating with advisers, we’re continuing to deliver award-winning innovative platform functionality that enables industry transformation and empowers you to add value for your clients.

Together, we’re creating Australia’s Best Platform

Use your preferred wording for asset classes and risk/return categories

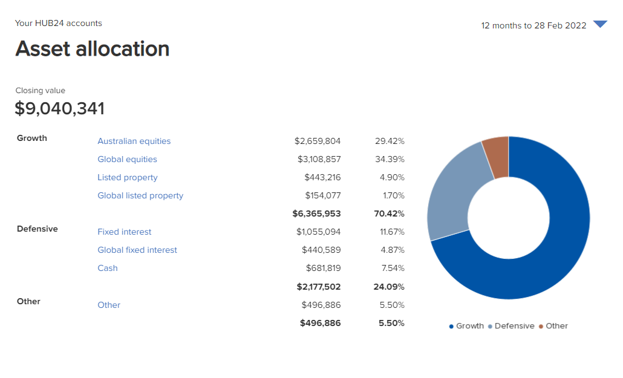

You now have greater flexibility to customise the names of asset classes and risk/return categories. Save time with ready-to-go asset allocation reporting in HUB24 Present consistent with the language you use and your clients understand. Your custom asset class settings will also appear on the Portfolio Dashboard. Here are examples of customisations available:

- Rename or add risk/return categories – Rename the ‘Defensive’ category to ‘Income’.

- Add asset classes – Add a new asset class for ‘Infrastructure’.

- Rename asset classes – Rename ‘Listed property’ to ‘Listed property and infrastructure’.

- Map your preferred risk/return category for each asset class – Change the mapping of the ‘Direct property’ asset class to fall under ‘Growth’ instead of ‘Other’.

- Set your preferred display order – Re-order from the most liquid to least liquid asset class.

Align asset allocation with your practice or licensee’s investment approach

Most importantly, you can now ensure that the asset allocation in HUB24 Present aligns with your organisation’s views.

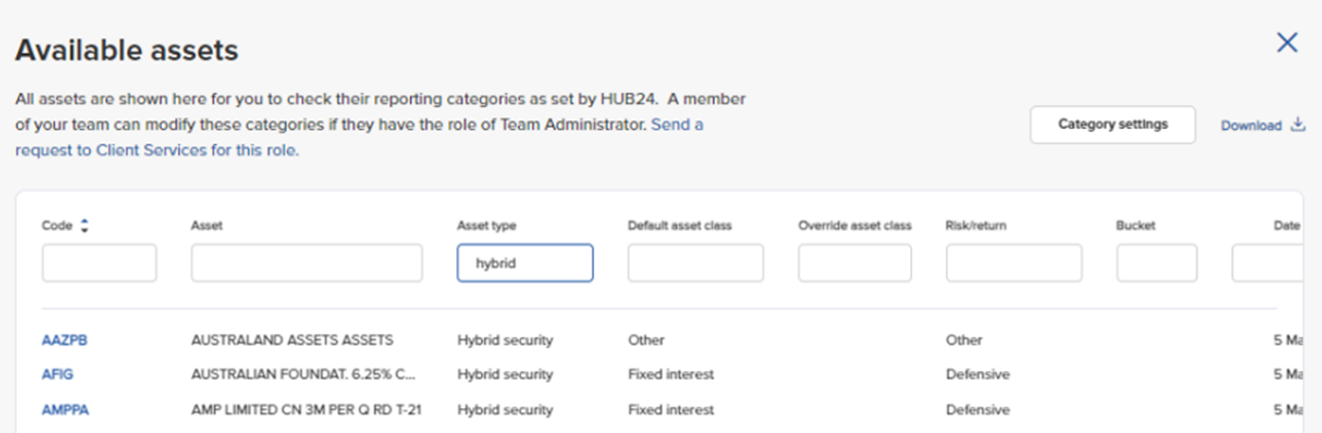

- Override the default asset class settings for individual assets – Override the default asset class settings for hybrid securities to categorise them as 50% ‘Australian equities’ and 50% ‘Fixed interest’, for example. This process can also be completed in bulk for multiple assets using the file upload feature.

- Override the risk/return category for individual assets – You can override the default risk/return category for an individual asset if required. For example, an ETF’s asset class might be ‘Fixed interest’ but it has risk/return characteristics that make it more ‘Growth’ than ‘Defensive’.

Discover the benefits

- Less time required to explain and prepare a picture of asset allocation for clients that is consistent across advice documents, reports and meetings.

- Alignment with your investment approach, as you can control the classification of assets for asset allocation reporting .

- Engaging clients in more meaningful conversations about their wealth with on-demand client presentations using HUB24 Present.

- Consistency with your Compliance procedures.

Want to get started?

You need to be a Team Administrator to create and assign custom asset categories. For more information, please refer to the next section.

In AdviserHUB:

- Go to HUB24 Present and select the Assets button.

- Alternatively, navigate to the Settings > Asset categories menu.

Keep in mind that your Team Administrator may already be assigned (e.g. if you’re part of a larger licensee, this role may be managed by the head office team). To find out, click the ‘Assets’ button in the top right-hand corner of HUB24 Present.

When you get to the ‘Available assets’ screen, the text at the top will inform you if the HUB24 defaults currently apply or whether your organisation is managing the customisation of asset categories.

- If HUB24 is listed, you can use the ‘Send a request to Client Services for this role’ link to request the Team Administrator role.

- If your organisation is listed, get in touch with a member of your head office team to learn more or request Team Administrator access.

Where can you find additional information and support?

- Your local Training & Relationship Manager: Contact your local TRM.

- Client Services: Connect with the team via chat on AdviserHUB, email or on 1300 854 994.

Related information

- Recent platform enhancements

- Save time with interactive client presentations at your fingertips

- Create a complete view of wealth for your clients on HUB24

- New market-leading Bucket Strategy presentation in HUB24 Present

- Add automated feeds for select cash accounts and term deposits

Return to the Recent Platform Enhancements page.

Disclaimer: The information on this website is produced by and on behalf of HUB24 Limited (ABN 87 124 891 685) and its subsidiaries (HUB24 Group). HUB24 Custodial Services Ltd (ABN 94 073 633 664, AFSL 239 122) is the operator of HUB24 Invest (an investor directed portfolio service), promoter and administrator of HUB24 Super which is a regulated superannuation fund. The trustee and issuer of interests in HUB24 Super is HTFS Nominees Pty Limited (ABN 78 000 880 553, AFSL 232 500, RSE Licence No. L0003216).

The information on this website is general in nature only and does not take into account any person’s objectives, financial situations or needs. Accordingly, before acting on any information on this website, the viewer should consider the appropriateness of the information having regard to their objectives, financial situation and needs, read the HUB24 Financial Services Guide and the relevant disclosure documents, and seek independent professional advice before making any decision to acquire or hold a financial product. HUB24 Limited and its subsidiaries disclaim all liability for any loss suffered by any person arising from their reliance on, or otherwise use of this information.