Managing cybersecurity in your practice: The rise of client portals

In FY23-24 Australian Cyber Security Centre received more than 36,700 calls to its Cyber Security Hotline, an increase of 12% from the previous year.

CyberHUB has been created in collaboration with HUB24, myprosperity and industry experts, to deliver valuable insight into how advice practices are tackling the critical issue of cyber security. Client portals like myprosperity play a pivotal role in strengthening cyber resilience in advice practices, and empower advisers to enhance client engagement and drive business efficiencies.

Client portals emerge as the cybersecurity solution

Reading time: 2 minutes

The need for accessible advice continues to grow while Australians face a cost-of-living crisis, high interest rates and the socio-economic changes that come with the transfer of intergenerational wealth estimated to be $3.5 trillion in assets by 2050.1

The opportunity for financial professionals to support more Australians is significant, however meeting the demand and the need for financial services will have its challenges. CPA Australia and CAANZ have estimated that more than 10,000 new accountants per year are required until 2026 to meet domestic demand.2

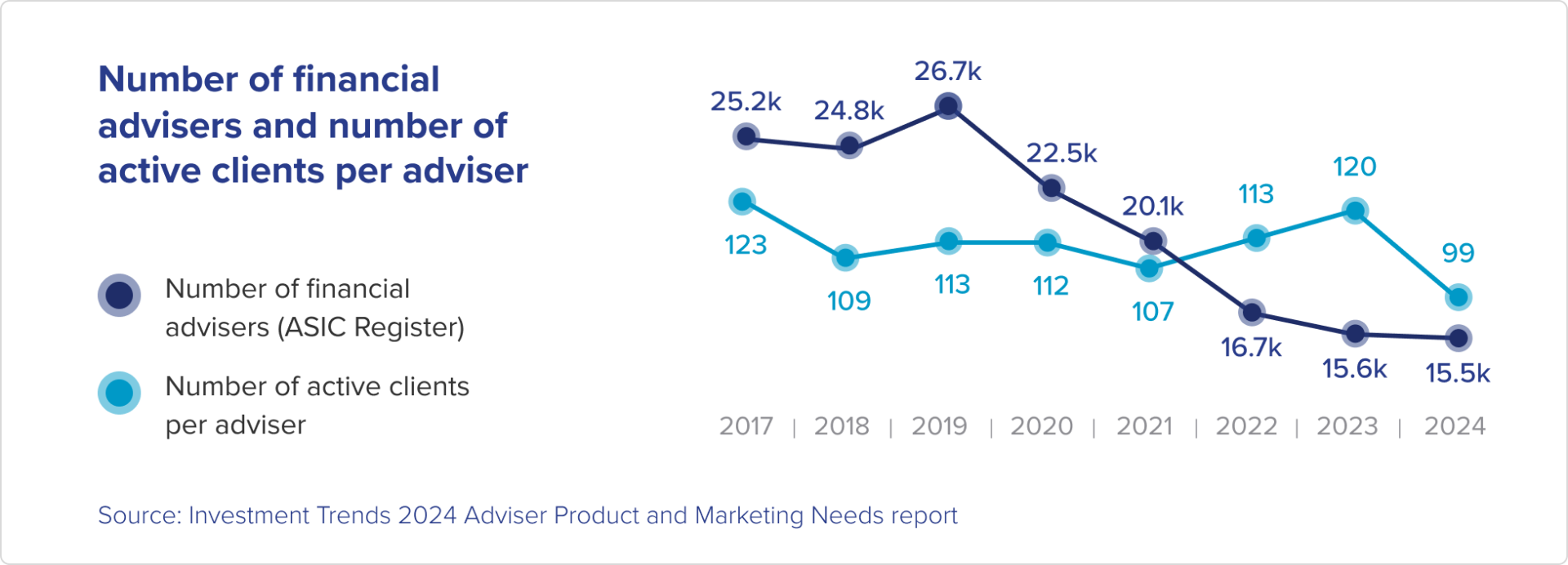

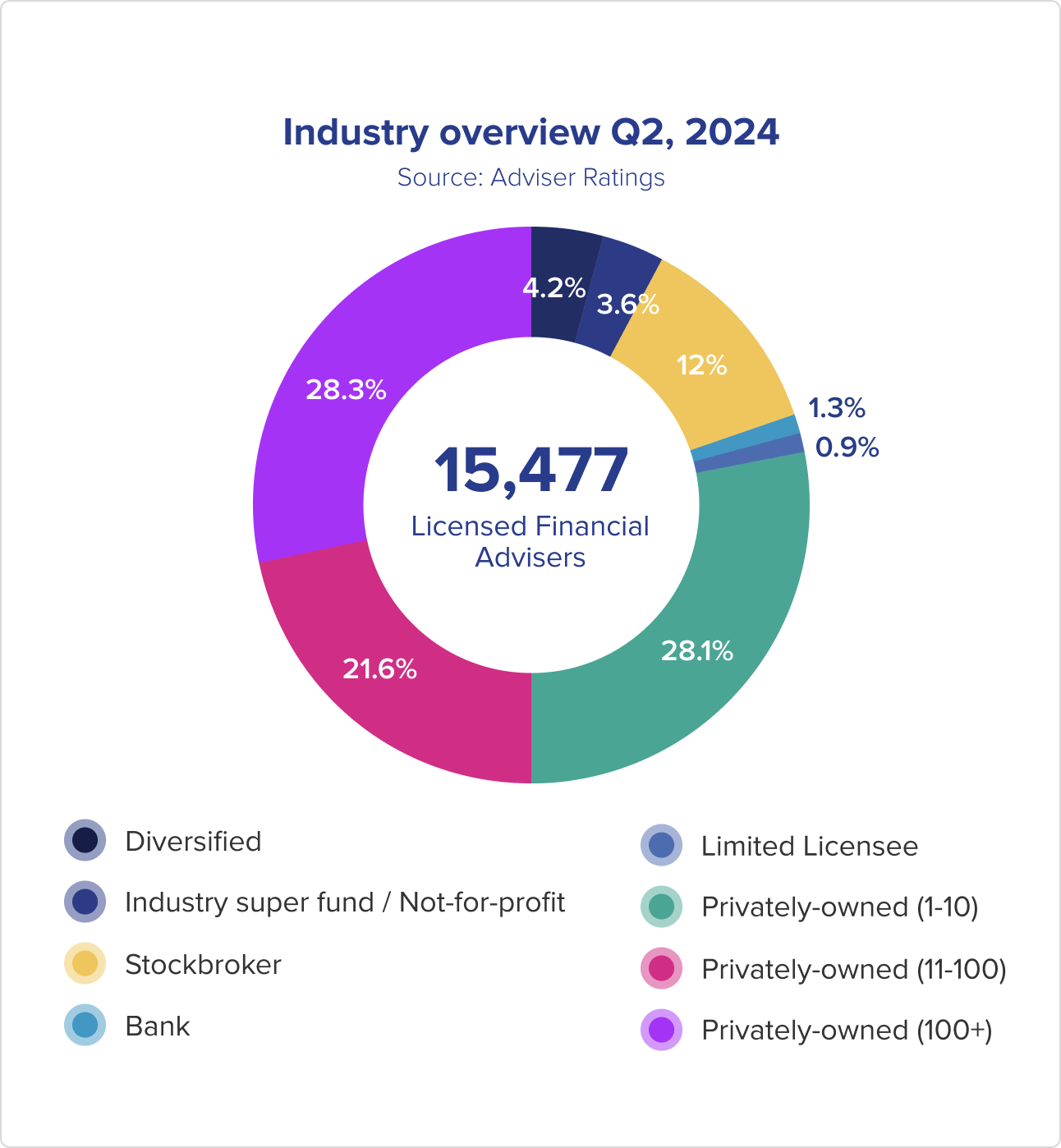

Meanwhile, in the financial advice industry, there are currently 15,415 advisers, a number that has decreased by 40% since 2018 and which has stagnated since the beginning of 2024.3

Closing the gap requires significant gains in productivity, so financial professionals can spend less time on manual processes and more time seeing clients.

According to the 2024 Adviser Business Model Report, the average number of clients serviced by advisers decreased by 17.5% between 2023 and 2024, from 120 clients per adviser, down to 99.

With adviser numbers stagnating, the growing demand for advice will require average client numbers to increase closer to 200 clients per adviser. 4

While some businesses aim to decrease the number of clients they serve in order to focus on building deeper and more valuable relationships, others, with the help of suitable technology solutions, will seize the opportunity to enhance productivity and expand their client base.

What are the main points of vulnerability and what can be done about it?

By integrating technology solutions into advice, practice efficiency and productivity can be improved, driving enhanced client experience while also enabling growth in clients.

With emerging technology comes new risks including cybercrime, which is not only on the rise, but leaves financial professionals significantly exposed given the large amount of personal information they rely upon to provide tailored financial advice.

Limited resources and the absence of specific knowledge to identify, manage and respond to cyber threats, puts small businesses at a high risk of being targeted by criminals.

Client portals are fast becoming the solution to this challenge, driving secure digital interactions with clients and their data. They enable financial professionals to securely share documents and reports with their clients, effectively mitigating a business’s exposure to cyber threats.

Source: Ensombl PD Day featuring HUB24 Executive Group Strategy Greg Hansen interviewing myprosperity Founder, Peter McCarthy.

Learn more about our all-in-one secure client portal

Dive deeper into the conversation

The rise of cybercrime

Cybercrime involves activities such as compromising emails, business emails and online banking fraud, which according to the Australian Government’s Australian Signals Directorate (ASD), currently make up the top three cybercrime types for business.

The Regulator’s stance on cyber

Although the Australian Investment and Securities Commission’s (ASICs) does not prescribe technical standards on cybersecurity, there is an expectation for licensees to address cyber risk as part of their AFS licence obligations, including risk management.

Mandating cyber change – A case study

A high profile cyber case involving a large licensee, together with a business email compromise a few years earlier, prompted Centrepoint Alliance to set internal standards and to mandate cyber requirements for its adviser network.

Letter box versus Inbox – security does differ

Two decades ago, important documents were sent in the mail and stayed in our letter box until we collected it, but this has been replaced with email and cluttered inboxes, leaving it prone to cyber security threats.

Cyber threats – Current response from financial professionals

Despite financial professional’s concern over cyberthreats, most have not acted fast enough and taken advantage of the appetite for change and the tail winds provided by government websites, cyber campaigns and media coverage.

Cyber resilience and its application

Over the past decade, Government and regulators have built a framework of governance for businesses to provide them with a structured approach to cyber-incidents and accountability.

Cyber security quick wins – Tips and techniques

Developing a cyber risk management plan takes some time, but there are some strategies that financial professionals can put in place while it does this, including such multi-factor authentication and protecting domain names.

Trends from the US – What does this mean for your business

Research in the US by Adviser 360 has found advice businesses that fail to invest in technology solutions to be more productive and better able to satisfy their clients, run the risk of being left behind.

How does your digital client experience stack up

Consolidated logins where customers use one login to access a range of services is now the norm and they have become a common way for people to engage with their service providers, setting the standard on client experience.

It’s time to transition to client portals – A case study

With cyber now listed as a major risk for the company, client portals have enabled Centrepoint Alliance’s adviser network to meet its mandated cyber standard and to facilitate client engagement and security.

Imagine the possibilities – Key benefits of client portals

Client portals are fast emerging as a core capability in nurturing safe and secure collaboration between clients and their financial professionals.

Whole of wealth approach with client portals – A case study

An early adopter of client portals, Sherlock Wealth’s Owner and CEO, Andrew Sherlock, said it’s an integral piece of technology that his business uses with many of its clients.

Break the reliance on email – Together, we can make a difference

Financial professionals, as trusted advisers, can take a leadership position in ensuring data security with their clients, leveraging client engagement to provide them with a reason to do it.

1 2021 Productivity Commission report Wealth Transfers and their Economic Effects November 2021

3 Q2 2024 Adviser Musical Chairs Report Adviser Ratings

4 2024 Adviser Business Model Report Investment Trends