HUB24 Discover

Support your client needs across their wealth journey – with a solution that spans generations.

$3.5 trillion is set to transfer across generations over the next two decades. Are you ready?1

As the intergenerational wealth transfer and aging population contribute to a demographic shift in the financial landscape, advisers continue to evolve their client acquisition and service offerings to cater for younger clients with simple investment needs, who will soon grow to a substantial portion of their client base. For these clients, it often coems down to simplicity and cost, and we’re empoering you to meet their needs with HUB24 Discover.

Building for tomorrow’s strategy, today.

We’ve listened to you and broadened the range of our investment menus to give you the flexibility to meet the needs of more of your clients throughout their wealth accumulation and retirement journey, all in one place.

To support the needs of early-stage wealth accumulators, later stage retirees, and anyone with simple investment needs, we’re introducing an innovative offering which provides a cost-effective investment option for your clients. HUB24 Discover provides a streamlined selection of managed portfolios by leading portfolio managers, with a simple, cost-effective fee structure, all on our award-winning HUB24 platform.

As your clients’ needs evolve, they can transition to our Core and Choice menus and access the benefits of a wider range of investment options while retaining the same account and underlying investments without incurring significant costs or CGT.2

HUB24 Discover Portfolio Managers

Select range of managed portfolios

We’ve collaborated with leading managers to deliver a selection of passive, active and ESG portfolios designed to support the needs of clients with simple investment needs.

Simplified fee structure

The HUB24 Discover menu offers value with no administration fee, no minimum fee, and no account keeping fee.3

Portability to support wealth journey

As client needs evolve, they can easily transition to our Core and Choice menus and access the benefits of a wider range of investment options while retaining the same account and underlying investments, where applicable.

Learn more about HUB24 Discover

Discover menu

Our Discover menu provides cost-effective access to a streamlined selection of managed portfolios by leading portfolio managers. This menu may suit early-stage wealth accumulators, later stage retirees, and anyone with less complex investment needs.

A selection of managed portfolios from leading portfolio managers with the benefit of no administration or account keeping fees, backed by our innovative managed portfolio functionality.

HUB24’s cash account is a transaction account that supports the broad range of services provided to your clients, including investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Core menu

Our Core menu provides your clients access to a select range of investment options, with the benefit of lower minimum administration fees and no account keeping fee. This may be a great option for clients who have a lower account balance; or straight forward investment needs.

In our Core Menu, we offer a selected range of multi-sector portfolios, backed by award-winning managed portfolio functionality.4

90-day, 180-day and 365-day term deposits from a range of providers.

HUB24’s cash account is a transaction account that supports the broad range of services provided to clients of the platform, for example investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Choice menu

Our Choice menu offers your clients a full suite of investment options, allowing greater choice and flexibility. This menu may suit clients with a larger account balance who would like to benefit from our full range of investment options.

Choose from a list of over 1,000 managed funds from more than 50 Australian and Internation fund managers.2

Access a wide range of multi-sector and single-sector portfolios, backed by award-winning managed portfolio functionality.4

Your clients can invest directly in Australian listed securities including listed shares, exchange-traded funds, other exchange-traded products, listed investment companies, interest rate securities and hybrids (such as preference shares and convertible notes).

Your clients can invest directly in a wide range of international listed securities from more than 15 international exchanges across the US, Asia and Europe, including an extensive range of US-listed ETFs.

90-day, 180-day and 365-day term deposits from a range of providers.

HUB24’s cash account is a transaction account that supports the broad range of services provided to clients of the platform, for example investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

Insights

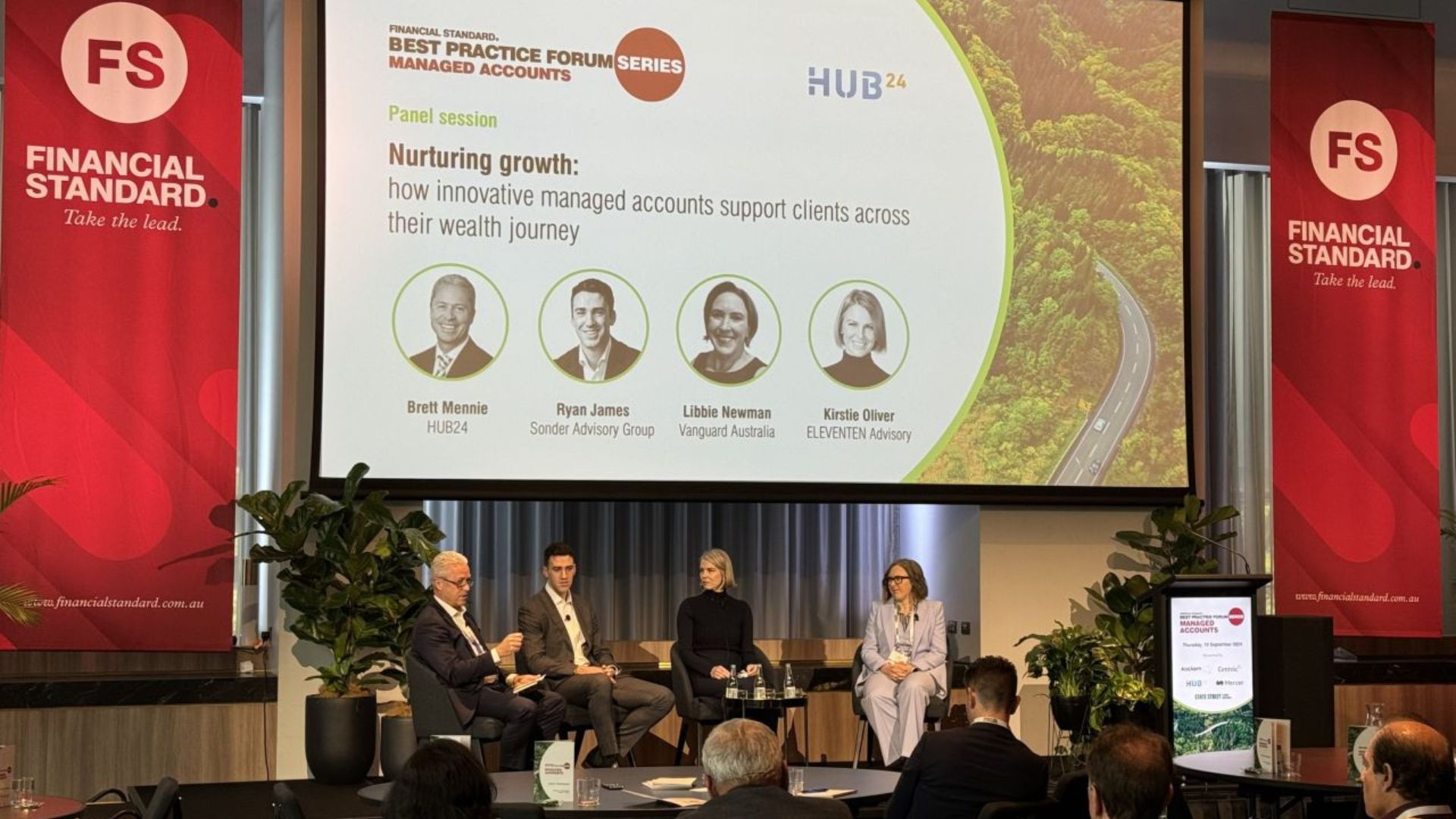

ELEVENTEN is based in Carlton, Melbourne and caters to high-net wealth families including specialist medical practitioners working in the area.

ELEVENTEN is based in Carlton, Melbourne and caters to high-net wealth families including specialist medical practitioners working in the area.

Established in 2022 on Queen Street in the heart of Melbourne, Sonder Advisory Group has a diverse client base that

Established in 2022 on Queen Street in the heart of Melbourne, Sonder Advisory Group has a diverse client base that

Managed portfolios are becoming essential for delivering multi-generational advice, providing a broad range of benefits across age groups and client

Managed portfolios are becoming essential for delivering multi-generational advice, providing a broad range of benefits across age groups and client

View product documents

- Zenith Investment Partners Pty Ltd – Discover menu portfolios Download

- Vanguard Investments Australia Ltd – Discover menu portfolios Download

- State Street Global Advisors Australia Limited – Discover menu portfolios Download

- Morningstar Investment Management Australia Limited – Discover menu portfolios Download

- Russell Investment Management Ltd – Discover menu portfolios Download

- MLC Asset Management Services Limited – Discover menu portfolios Download

- Lonsec Investment Solutions Pty Ltd – Discover menu portfolios Download

- Infinity Asset Management Pty Ltd – Discover menu portfolios Download

- Elston Asset Management Pty Ltd – Discover menu portfolios Download

- DFA Australia Limited – Discover menu portfolios Download

- BlackRock Investment Management (Australia) Limited – Discover menu portfolios Download

- Betashares Capital Ltd – Discover menu portfolios Download

- AZ Sestante Limited – Discover menu portfolios Download

1. ‘How to get the great wealth transfer right’, Australian Financial Review, December 2019.

2. Where portfolios are different, part of the portfolio may trigger some capital gains tax (CGT) and other costs to realign the portfolio to the chosen option.

3. Investment management fees in respect of managed portfolios continue to apply. Please refer to PDS which, once available, can be accessed via the product website or via AdviserHUB.