Apr 2025

SAME-DAY IMPLEMENTATION OF YOUR SUPERANNUATION STRATEGIES SUCH AS RE-CONTRIBUTIONS OR SUPER-TO-PENSION TRANSFERS

14 Apr 2025

With our new online experience, Super-to-Pension transfers and Re-contribution requests between existing accounts are now processed same-day, driving efficient implementation of your superannuation strategies.

To access, simply login to AdviserHUB and navigate to the Internal Transitions dashboard. From here, you will be able to click ‘Add internal transition’ and proceed to complete the online forms.

This enhancement is part of continuous improvements designed to enhance your digital experience so you can better service your clients on the platform, without the reliance on paper-based forms.

LINK YOUR CLIENTS’ ACCOUNTS ONLINE FOR CONSOLIDATED REPORTING

14 Apr 2025

We’ve listened to your feedback and enhanced the online grouping feature so you can now link accounts that are not eligible for fee aggregation to a family group. This change will enable you to produce consolidated reporting for linked accounts across all account types such as Core, Choice and Discover.

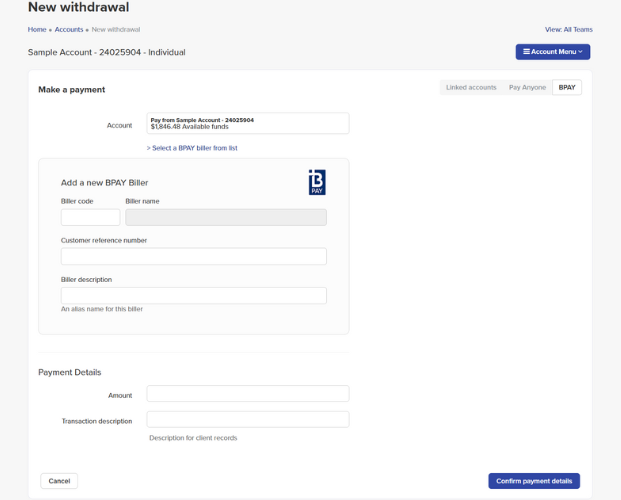

EASIER CASH MANAGEMENT WITH BPAY®

2 Apr 2025

We’ve introduced the BPAY facility in the Investor Directed Portfolio Service (IDPS) to help you manage your client accounts more efficiently and enable you to process payments to third-parties via BPAY.

This new payment method can be used once a client has accepted the terms and conditions available in InvestorHUB. Any payments to new billers will also require consent from your client. To make payments easier, we’ve also removed minimum withdrawal amounts. To get started, navigate to the new withdrawal page in AdviserHUB.

MORE CHOICE AND FLEXIBILITY WITH NEW MANAGERS ON HUB24 DISCOVER

1 Apr 2025

We’ve listened to your feedback and have enhanced our HUB24 Discover solution to provide you and your clients with greater choice and flexibility.

More Portfolio Managers to choose from

We’ve increased the number of portfolio managers, giving you access to a broader range of expertise. HUB24 Discover now includes portfolios from Dimensional, State Street Global Advisors, Russell Investments, MLC Asset Management and Infinity, sitting alongside the existing portfolios from Vanguard, Betashares, BlackRock iShares, Lonsec, Morningstar, Elston, Zenith and AZ Sestante.

Expanded Portfolio Options

The range of passive and active managed portfolio options has grown from 36 to 66 options, providing more choice and flexibility for your clients.

Low-Cost Options

We’ve expanded our range of low-cost index and index plus portfolios, making it easier for you to offer cost-effective solutions for your clients.

Higher Growth Options

We’ve added further growth options including an internally geared portfolio option, to meet the needs of clients with greater risk appetites.

Direct Share Ownership

For clients who prefer the portability of direct ownership of underlying shares, we’ve introduced a range of active multi-asset portfolios with direct exposure to Australian shares.^

^ These portfolios require a minimum investment of $50,000.

Mar 2025

TAILOR FEE ARRANGEMENTS WITH OUR LATEST ADVICE FEE EXCLUSION CAPABILITY

24 Mar 2025

Our Advice Fee Exclusion feature allows you to tailor fee arrangements with your clients by excluding specific investment types—such as term deposits, term annuities, and cash account balances—when calculating advice fees.

We’ve recently enhanced this functionality to provide even greater flexibility. You can now also exclude foreign currency and unlisted bonds from your fee calculations.

To access, simply login to AdviserHUB and navigate to Accounts > Advice fees and click on the ‘fee exclusion’ quick link on the main dashboard.

This enhancement is part of ongoing changes to our Advice Fee capability to improve and streamline processes, drive efficiencies, and enhance transparency for advisers.

Dec 2024

MORE FLEXIBILITY WITH YOUR CHOICE OF INTERNATIONAL SECURITY TRADE SETTLEMENT

9 Dec 2024

Our latest enhancement allows you to nominate whether international security trades settle in Australian Dollars or in their native currency – helping your clients’ money work harder for them by saving on transaction costs associated with foreign currency conversions. And we’re making it easy to determine your foreign currency position with our foreign currency estimate tool, so you can deliver better outcomes for your clients.

GREATER EFFICIENCY USING BULK FEE CONSENT

9 Dec 2024

We continue to deliver on our commitment to drive more productivity in your business with our streamlined digital advice fee consent tool, which now enables you to process multiple fee consents at one time. You can send multiple fee consent requests or generate our pre-populated form in bulk for easy management of your upcoming fee arrangements.

Nov 2024

MORE EFFICIENCY WITH OUR DIGITAL ADVICE FEE CONSENT TOOL

11 Nov 2024

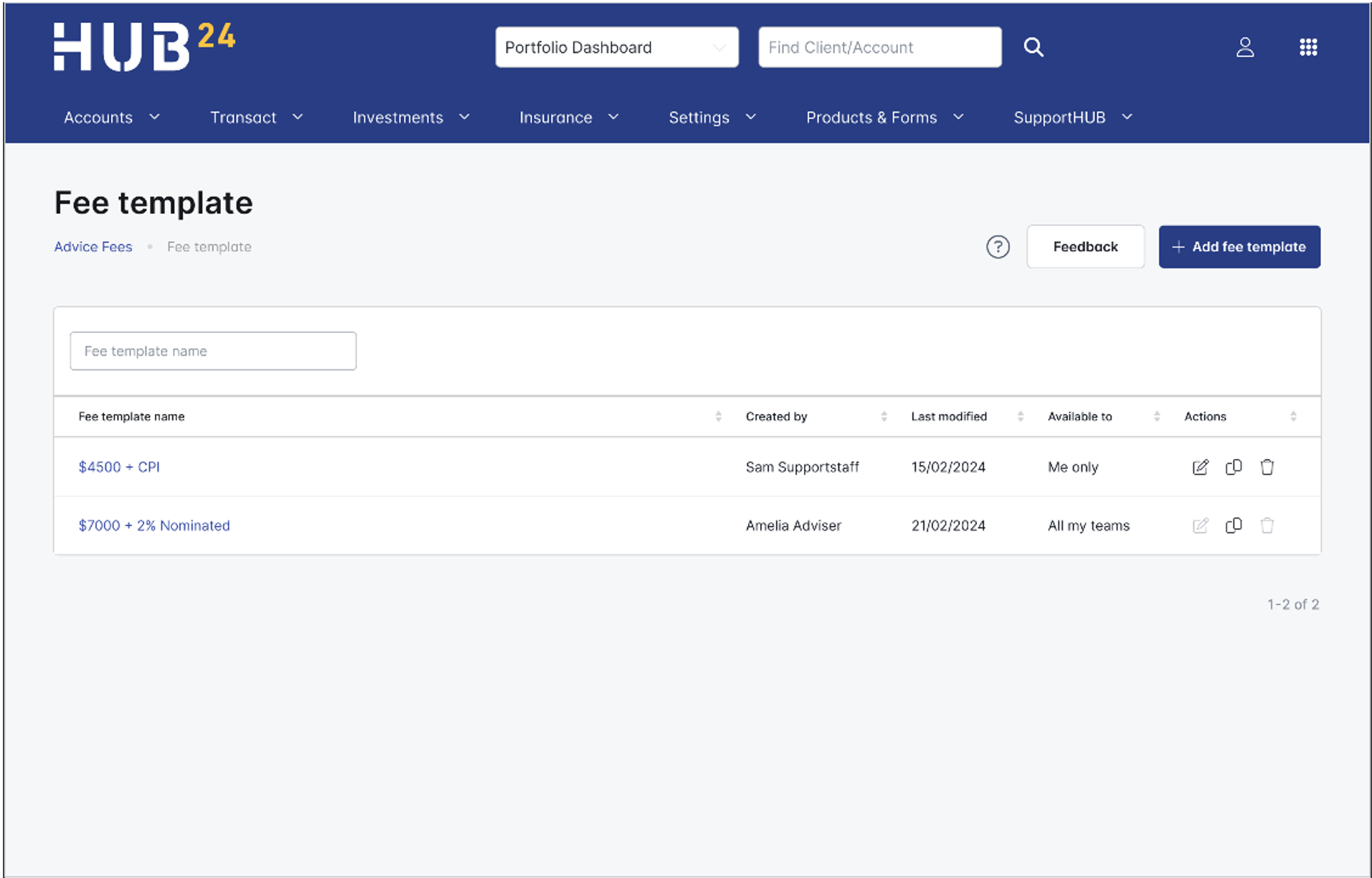

New custom fee templates

We’ve delivered new fee template capability to drive efficiency in your business and save you time when processing advice fee consent requests. You now have the ability to create custom templates that can be used to quickly populate fees. They are simple to apply across multiple accounts using the digital advice fee consent tool.

Resend capability

We’re driving efficiency in your business with our resend capability by enabling you to resend advice fee consent requests to clients when they have not yet approved the request. Instead of sending a new request, you can resend the existing advice fee consent request as a reminder using email or via InvestorHUB.

Future start date

We’re increasing visibility with the addition of upcoming fee arrangements on our advice fee consent dashboard. You can now view fee arrangements that have a future starting date to help you better manage your consent requests.

Oct 2024

MORE FLEXIBILITY AND CHOICE WITH OUR NEW INVESTORHUB CONSENT METHOD

21 Oct 2024

Our new InvestorHUB consent option provides greater choice and flexibility for advisers to request consent from their clients in a way that suits them. This addition means all advice related fees now have a digital process and the same flexible range of consent options to choose from:

- Via InvestorHUB

- Via HUB24 digital email consent

- Via pre-populated form

INTRODUCING NEW ADVICE FEE CONSENT FORM UPLOAD CAPABILITY

21 Oct 2024

We continue to streamline our advice fee consent process and have introduced new form upload capability where HUB24 or third-party consent forms can be uploaded directly into the platform for straight through processing (STP). This means improved turnaround times, and offers advisers greater efficiency and transparency in handling fee consent requests.

Our upload capability can be accessed by navigating to Advice fee > Upload consent form.

From 28th October, all fee forms must be uploaded via AdviserHUB as we will no longer be accepting email submissions. This enables us to service your requests more efficiently and provides you with greater visibility of your fee consent requests. You can keep track of all requests on the dedicated advice fee consent dashboard.

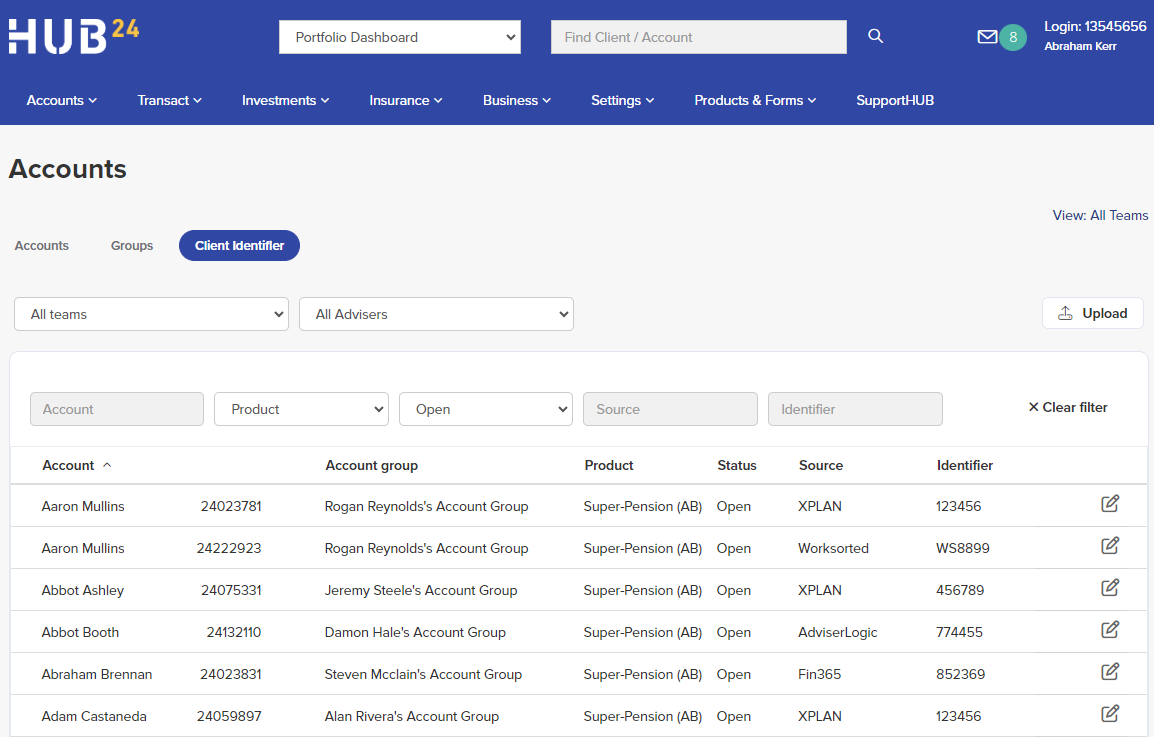

GREATER CONTROL AND FLEXIBILITY WITH OUR NEW CUSTOM REPORTING FIELD

21 Oct 2024

We understand there are times when you need to generate a practice report that identifies your HUB24 clients alongside their client identifier from an external source.

To help you effectively manage your client data across systems, we have introduced a new Client ID tab in the Accounts menu that enables you to supply unique identifier information. This means you can identify and track your clients more easily and will display on screen, as well as within two existing Business Reports (i) Health Check Report and (ii) Adviser Fee Schedule by Account. These reports can be exported and the relevant data merged with off platform reports you generate.

Unique identifier information can be supplied for individual accounts on the new Client ID screen, or in bulk by uploading a CSV file (HUB24 account number, source, identifier). Identifiers can be edited or deleted any time from the Client ID tab.

We’ve also made enhancements to the Health Check Report in response to adviser feedback with the inclusion of an additional column for Dollars ($) held in cash .

These additional fields will elevate your reporting capability and can be easily exported, saving you time when consolidating your reports.

Sep 2024

EASILY MOVE MONEY IN AND OUT WITH OUR ENHANCED CASH MANAGEMENT CAPABILITIES

25 Sep 2024

We’ve been continuously improving our cash management capabilities through a series of enhancements to empower you to save time and drive productivity in your business.

Whether it’s processing money in or out, we’ve made it easier for you to manage cash by streamlining the process and providing flexibility in third-party payment methods.

- Secure and paperless payments with Pay Anyone Facility

- Faster access to deposits with unique EFT payment details

- Convenience and flexibility when paying client funds

EASILY MANAGE YOUR ADVICE FEE REQUESTS USING OUR DIGITAL ADVICE FEE CONSENT TOOL

25 Sep 2024

Our latest enhancements to the digital fee consent tool support our dedication to driving productivity in your business with more efficient processing.

- One-off advice fee requests are now supported digitally as we continue to streamline fee consent requests on the platform.

- We’ve listened to your feedback and have refined our existing email consent template to improve the structure and visibility of key features for a better user experience.

- Last month, we introduced a new centralised dashboard to monitor and manage advice fee arrangements, as well as pre-populated consent forms to help drive productivity in your business.

Aug 2024

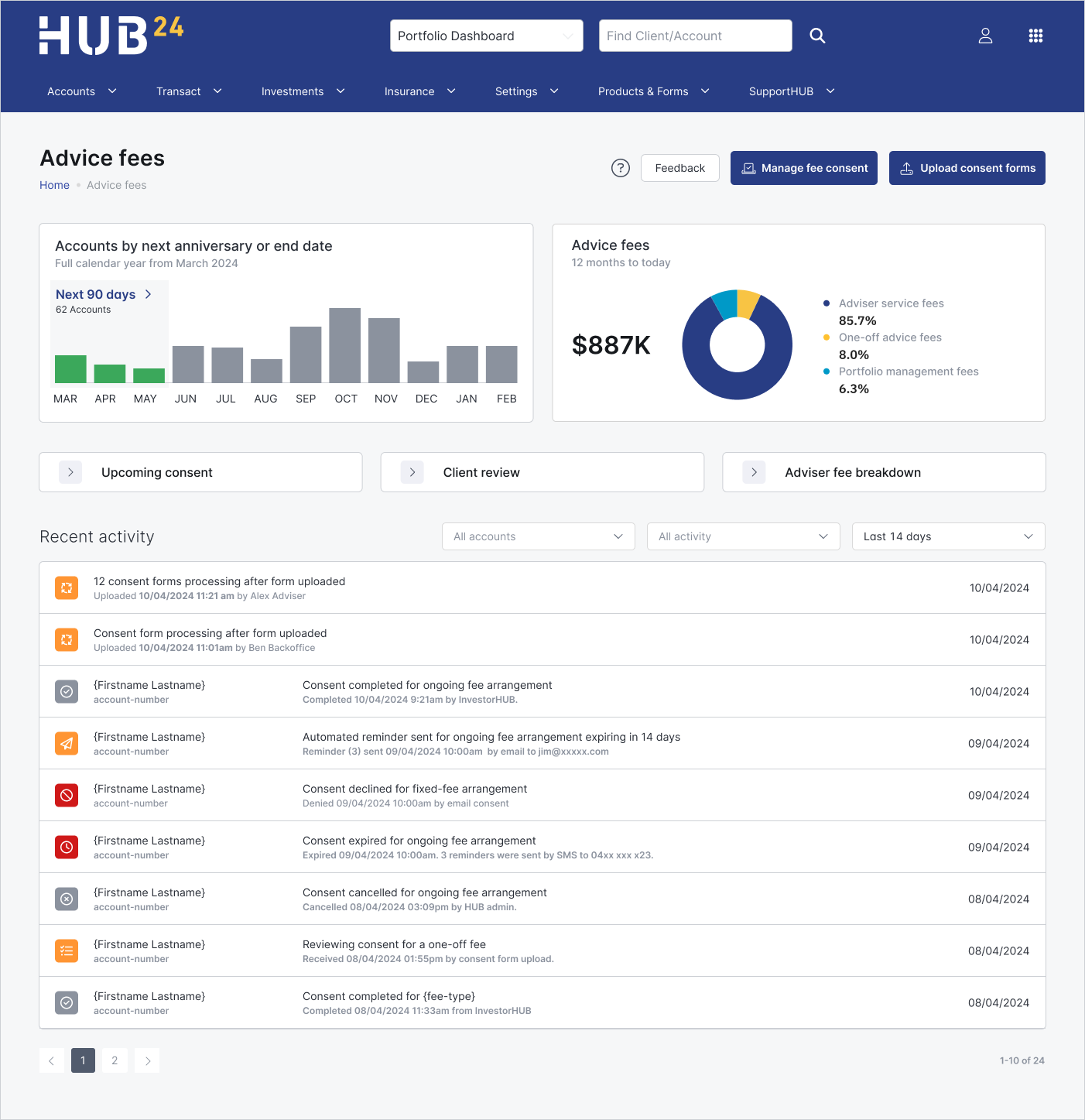

GREATER FLEXIBILITY AND EFFICIENCY TO MANAGE ADVICE FEE CONSENT WITH YOUR CLIENTS

12 Aug 2024

We’ve introduced a range of innovative enhancements designed to streamline the advice fee consent process and provide you and your clients with more choice and flexibility.

We’ve developed a centralised dashboard where you can monitor and manage your advice fee arrangements. Our new dashboard empowers you with greater visibility so you can track all current fee arrangements, request one-off advice fees, track the progress of renewals, see upcoming consent renewals and process new arrangements all in one place.

To access the new Advice Fee Consent dashboard, simply login to the AdviserHUB and navigate to Accounts > Advice fees

We’re driving productivity in your business with our digital solutions that enable you to securely request and manage consent more efficiently. You can now generate pre-populated PDF consent forms securely online for both renewal and new arrangements.

Jul 2024

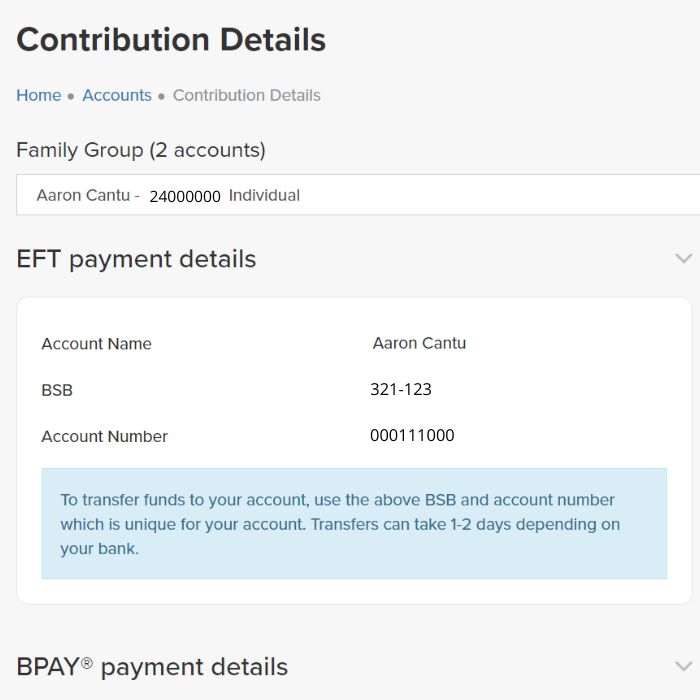

ENABLING FASTER ACCESS TO DEPOSITS FOR YOUR CLIENTS WITH THE ADDITION OF UNIQUE EFT PAYMENT DETAILS

29 Jul 2024

As part of our commitment to delivering a variety of cash management solutions, we have introduced new unique EFT payment details for all your clients’ accounts. This includes all SMSF client accounts, which will help avoid payment processing issues for employer Super Guarantee (SG) contributions and rollovers. The new details provide clients with faster access to deposits, once the funds are received by us, and enables efficient management of their funds via the application of a BSB and a unique account number. The unique EFT payment details will be progressively applied to your clients’ accounts, with all accounts receiving their new details by mid-September 2024.

AGE PENSION+ OPTION NOW AVAILABLE WITHIN AGILE

29 Jul 2024

To offer greater flexibility and certainty for you and your clients, AGILE now includes the Age Pension+ Option. The new Age Pension+ Option provides an adviser or retiree with the flexibility to choose if they want to access the higher potential age pension eligibility, as AGILE is subject to reduced assets test treatment for the Age Pension.

Jun 2024

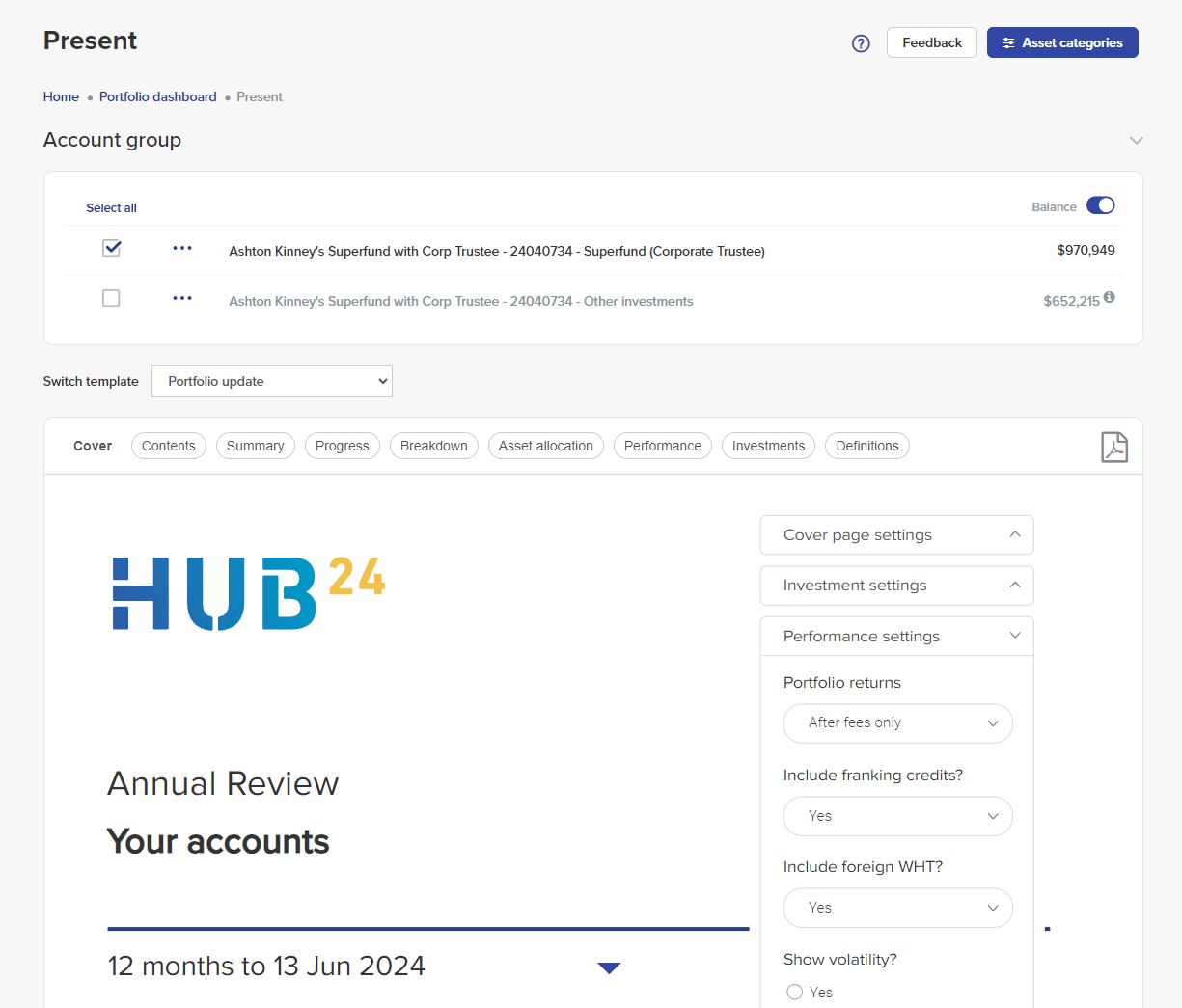

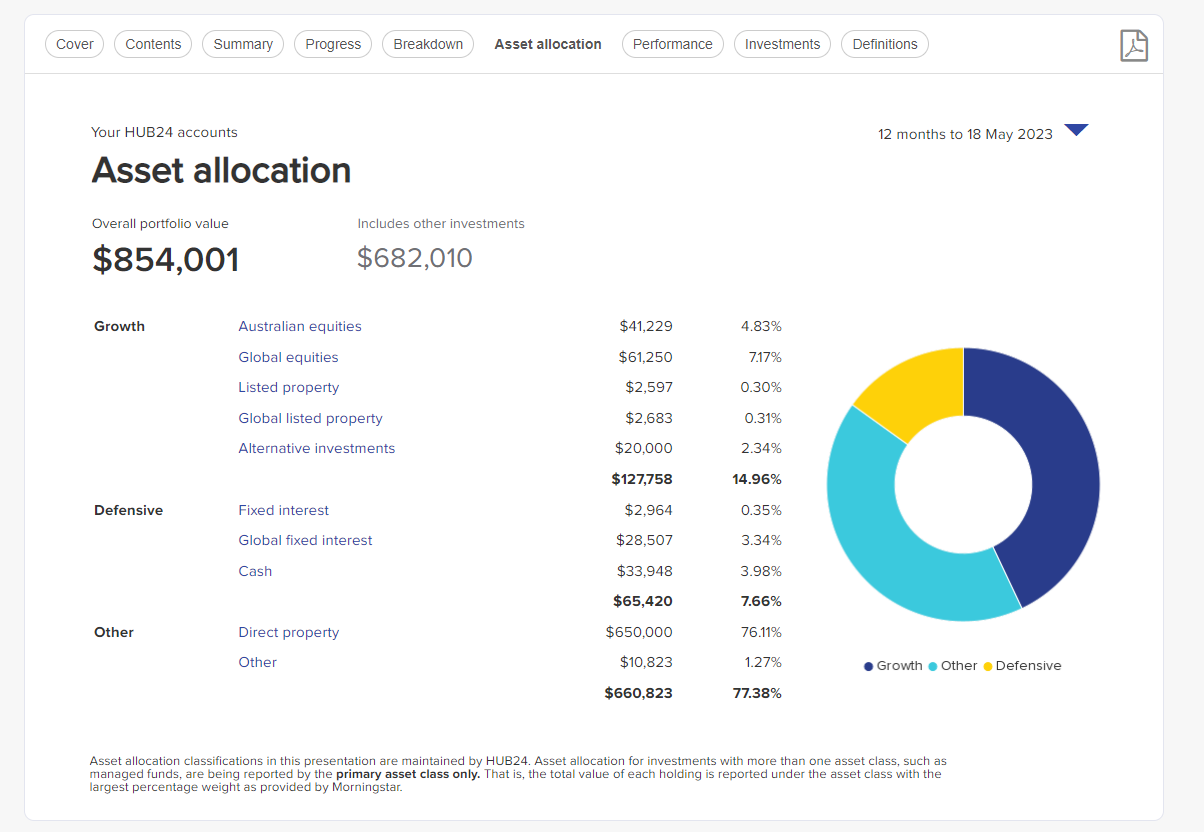

SAVE MORE TIME WHEN PREPARING INTERACTIVE CLIENT PRESENTATIONS WITH HUB24 PRESENT

17 Jun 2024

We’ve listened to your feedback, and we’ve made several improvements to our HUB24 Present feature to drive efficiency and flexibility for you and your clients:

- You can now export drill-down data, such as the consolidated holdings by asset class, as an Excel or PDF file.

- Your previous cover page settings will now be remembered for next time.

- We’ve expanded the drill-down options to include the performance time series used to calculate percentage returns.

- We’ve added new functions to the account group list, allowing you to select all accounts and hide account balances when presenting to family members across different households.

- We’ve improved the Summary slide in the Portfolio Update and Bucket Strategy Update templates and moved the option to switch templates to a more convenient location.

- You can now easily go back to the Portfolio dashboard by clicking the breadcrumb link at the top of the screen.

- We’ve added a new support guide, accessible next to the Feedback button at the top right of the screen.

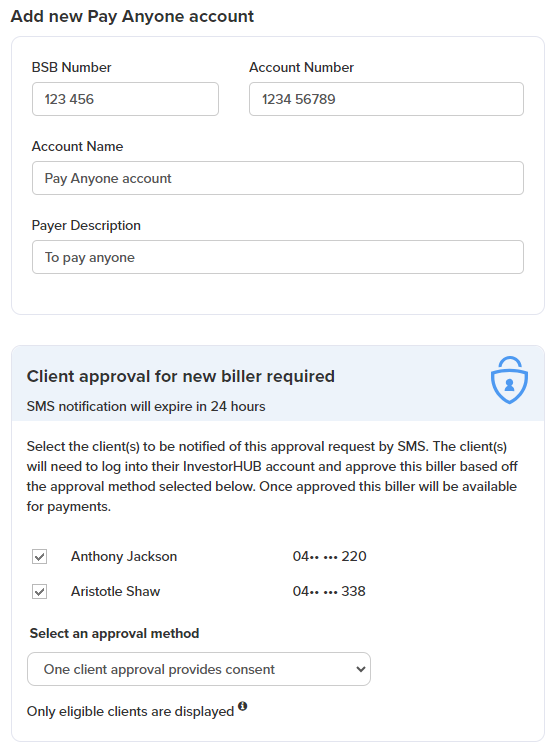

FLEXIBILITY AND CHOICE IN HOW YOU MANAGE CONSENT REQUESTS WITH PAY ANYONE FACILITY

17 Jun 2024

We are committed to providing seamless and secure transactions through our Pay Anyone Facility, allowing advisers to easily request third-party payments on their client’s behalf. Our latest enhancement better supports accounts with multiple holders (e.g. SMSF, Trust, Joint) as consent can now be requested from one or more account holders through InvestorHUB at the same time. We’re making things easier and providing greater flexibility and choice for you and your clients to manage these requests through InvestorHUB.

This is in addition to the existing functionality to request consent through SMS code. These enhancements to our Pay Anyone Facility reflect our dedication to empowering you to better serve your clients and drive productivity in your business.

Additional account holders will need to create an InvestorHUB login. Please complete the Pay Anyone Terms and Conditions and InvestorHUB Login Form available in AdviserHUB > Products & Forms > Forms.

Please refer below to the April enhancements release for a walkthrough on the client consent process.

May 2024

PERFORM IN SPECIE RE-CONTRIBUTIONS FOR A SEAMLESS AND EFFICIENT TRANSFER OF CLIENT ASSETS

28 May 2024

Chelsea Sciancalepore, BDM in SA, had a chat with two of the first advisers to trial our new in specie re-contributions process to hear about their experience. They said the process saved their clients money by avoiding unnecessary buy/sell costs and mitigated risks associated with physically selling down large sums. They also loved that their clients had visibility of the entire process and were able to maintain their investment strategies with no time out of market, and found the overall experience for their staff efficient and seamless.

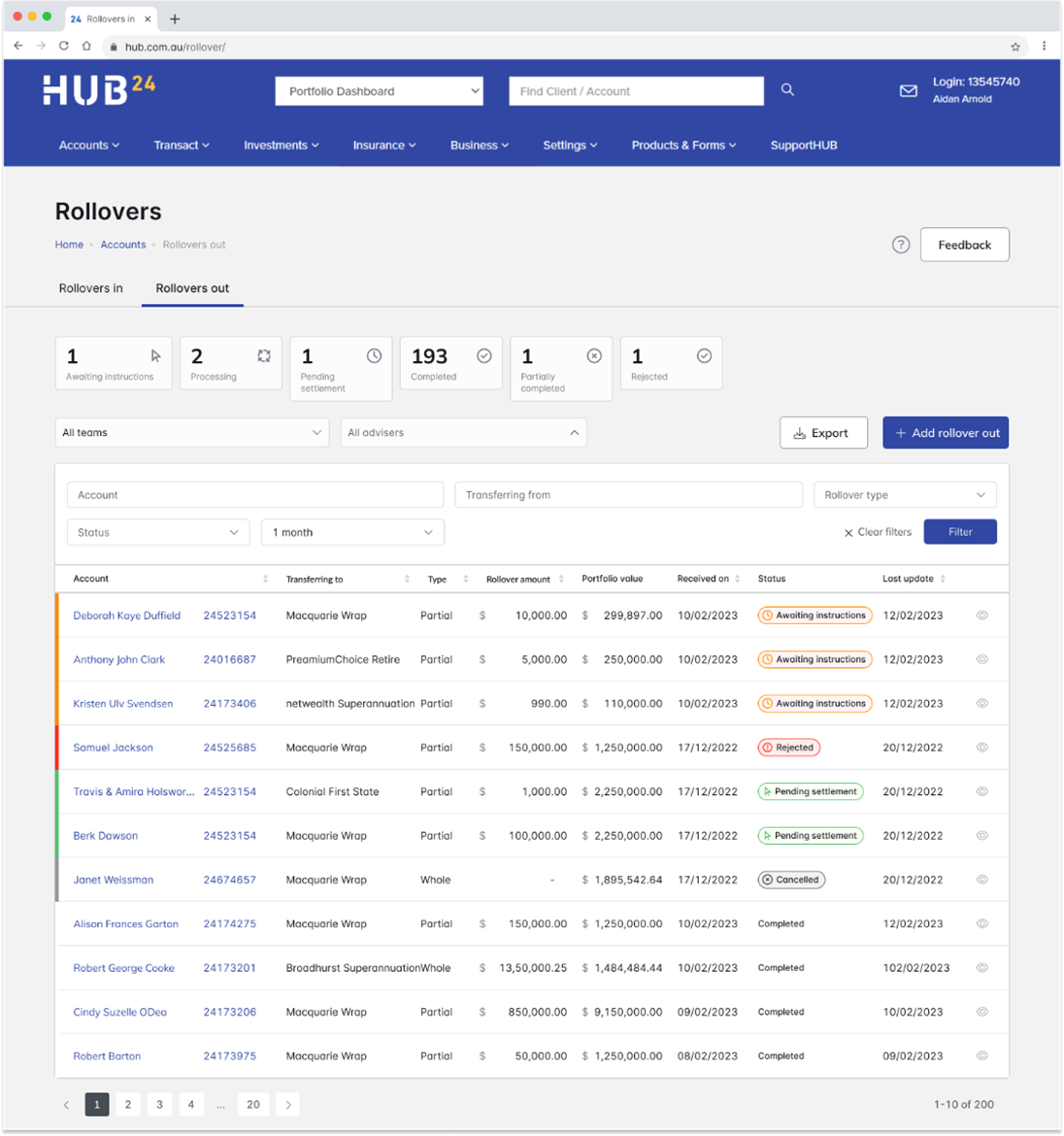

GREATER TRANSPARENCY AND FLEXIBILITY WITH THE INCLUSION OF ROLLOVER OUT REQUESTS IN THE ROLLOVER DASHBOARD

28 May 2024

Last year we introduced a new Rollover dashboard to help you manage Rollover In requests on behalf of your clients. To empower you with greater transparency and flexibility, we’ve extended the Rollover dashboard to include Rollover Out requests, making it even easier to manage rollover requests. With our new Rollover Out dashboard, you can now view received Rollover Out requests and provide relevant sell-down instructions and lodge a notice of intent to claim a tax deduction all from the one place. We’ve also launched three new account activity notifications to keep you across the detail.

To access the updated Rollover dashboard, simply login to AdviserHUB and navigate to Accounts > Manage Accounts > Rollovers.

Apr 2024

PERFORM IN SPECIE RE-CONTRIBUTIONS WITHOUT SELLING DOWN ASSETS OR THE NEED TO OPEN A NEW ACCOUNT

29 Apr 2024

By processing the assets in specie, we facilitate a seamless transfer and reduce the need for clients to sell down assets, withdraw funds to their bank accounts, or re-purchase assets in a new account. Clients can save on associated transaction costs and buy/sell spreads, and minimise out-of-market risks, ensuring their superannuation remains invested and aligned to your advice strategy.

Our streamlined process is flexible and makes it easy for you to implement re-contribution strategies with only a client consent form required for efficient processing.

Please note: Re-contribution requests must be submitted by 14 June 2024 to be processed by 30 June 2024.

SIMPLIFIED ACCESS TO ALLIANZ GUARANTEED INCOME FOR LIFE (AGILE) WITH INTEGRATED ONLINE ACCOUNT OPENING

29 Apr 2024

We’re collaborating with leading providers to deliver innovative retirement solutions for you and your clients. Offer peace of mind to your clients with AGILE a flexible retirement income solution that provides a guaranteed lifetime income, available to advisers and their clients on the HUB24 platform through HUB24 Invest & HUB24 Super. To simplify access to AGILE, you can now purchase the policy through AdviserHUB.

Access the form via Transact > Longevity Products > AGILE New Investment.

GREATER FLEXIBILITY FOR YOU AND YOUR CLIENTS WITH CONTINUED ENHANCEMENTS TO OUR PAY ANYONE FACILITY

29 Apr 2024

We’re continuing to enhance our Pay Anyone Facility to empower you to save time and drive productivity in your business. We’ve added a new client consent method to support your clients with flexibility and choice in how they provide consent for third party payments. In addition to our one-time passcode sent via SMS, eligible HUB24 Invest clients can now approve requests via InvestorHUB.

Mar 2024

GREATER INVESTMENT CHOICE FOR YOUR CLIENTS WITH FOREIGN CURRENCY TRADING

18 Mar 2024

We’ve added Foreign Currency Trading, our new direct foreign currency investment option, to HUB24 Invest to broaden our range of investment options and empower you to better service your clients’ needs. This new investment option allows investors and advisers to directly invest and trade in 11 foreign currencies within your client’s platform account.

Feb 2024

ELIMINATE PAPER FORMS AND DRIVE PRODUCTIVITY IN YOUR BUSINESS WITH HUB24’S PAY ANYONE FACILITY

20 Feb 2024

We’ve listened to your feedback and introduced a new Pay Anyone Facility on AdviserHUB. With this new enhancement, your HUB24 Invest clients can securely nominate new bank accounts with a one-time passcode sent via SMS, facilitating seamless payments to third parties.

Clients can provide consent to using the Pay Anyone Facility by accepting the T&Cs on InvestorHUB which can be found by selecting Accounts > Pay Anyone Terms & Conditions.

Please note: As a part of the changes, advisers will no longer have the ability to update their client’s details online. Clients will need to login via the client portal to update their details or you can complete a Change of Details form.

MORE INVESTMENT CHOICE FOR AUSTRALIAN UNREGULATED TRUSTS

20 Feb 2024

We’ve widened the available investment menu for your Australian unregulated trust clients on HUB24 Invest. These clients can now access a broad range of managed portfolios and international securities, alongside a variety of managed funds, Australian listed securities, Term Deposits and more.

MORE POWER TO MEET THE NEEDS OF YOUR NON-RESIDENT CLIENTS

20 Feb 2024

Your non-resident clients can now access a broad range of managed portfolios* and international listed securities*, alongside a variety of managed funds, Australian listed securities, Term Deposits and more.

To support taxation requirements for U.S. tax residents residing in the U.S., we’ve also introduced digital signatures for W-9 forms for withholding tax purposes.

*Excludes U.S. tax residents residing in the U.S. who cannot acquire US Securities or managed portfolios.

Find out how you can best support your non-resident clients.

Dec 2023

GREATER FLEXIBILITY TO SUPPORT YOUR HIGH-NET-WORTH CLIENTS WITH UNCAPPED TERM DEPOSIT OPTIONS

11 Dec 2023

We’ve partnered with NAB to introduce uncapped term deposit options within HUB24 Invest to better support your high-net-worth clients. You can now assign a greater investment allocation to term deposits without the previous limits on the aggregated investment amounts for term deposit providers, applicable to trust, company and partnership accounts. These term deposits are treated as non-retail deposits where the aggregated limits do not apply.

Note: As these term deposits are treated as non-retail deposits, the interest rates may differ from the standard platform term deposits due to different pricing methods.

For more information on the rates please see the Term Deposit & Rates page in AdviserHUB.

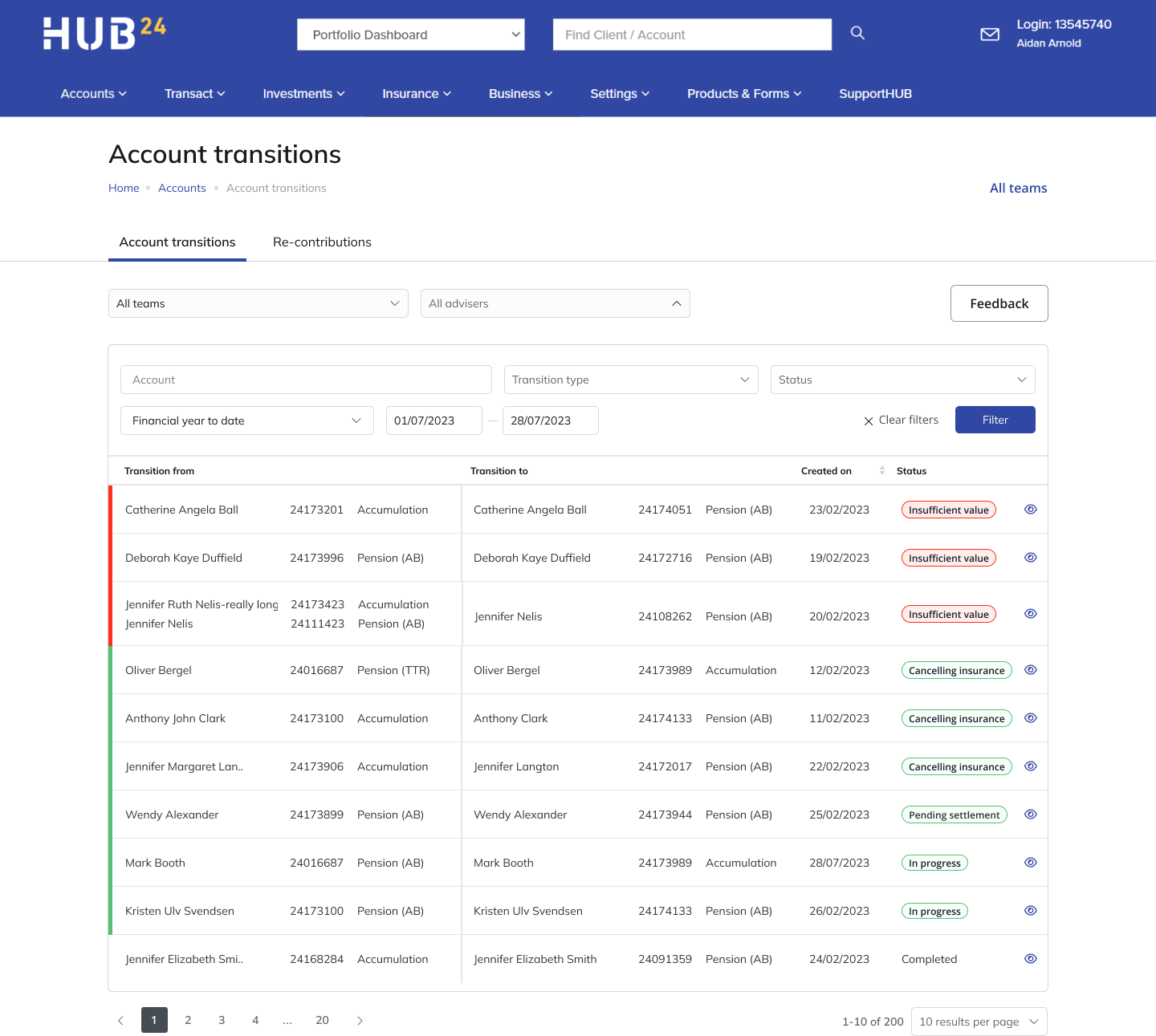

DRIVE EFFICIENCIES IN YOUR BUSINESS WITH NEW ACCOUNT TRANSITION AND RE-CONTRIBUTIONS TRACKING

11 Dec 2023

We’ve made some improvements to our Account Transition dashboard to allow you to request and track your super to pension, pension refresh and re-contributions strategy requests all in one place.

To access the new dashboard, log in to AdviserHUB and go to Accounts > Manage Accounts > Account Transitions.

To further streamline the Account Transition process, we’ve also introduced a new form that supports super to pension and pension refresh requests. You can find this form under Product & forms > Forms.

Note: This form is now required for all Account Transition requests.

Nov 2023

PLATFORM ENHANCEMENTS SUPPORTING CUSTOMER NEEDS ACROSS THEIR WEALTH LIFECYCLE

15 Nov 2023

We’re committed to delivering innovative solutions that creates value for you and your clients. That’s why we’ve announces several platform enhancements:

- Our new Discover Menu is a cost-effective solution that can help clients with simple investment needs meet their financial goals.

- In collaboration with Allianz Retire+, we’re providing access to AGILE (Allianz Guarantee Income for Life) on HUB24 Invest and HUB24 Super.

- We’ve introduced a range of investment options and features to support the needs of HNW (High Net Worth) clients and those with more complex investment needs.

Oct 2023

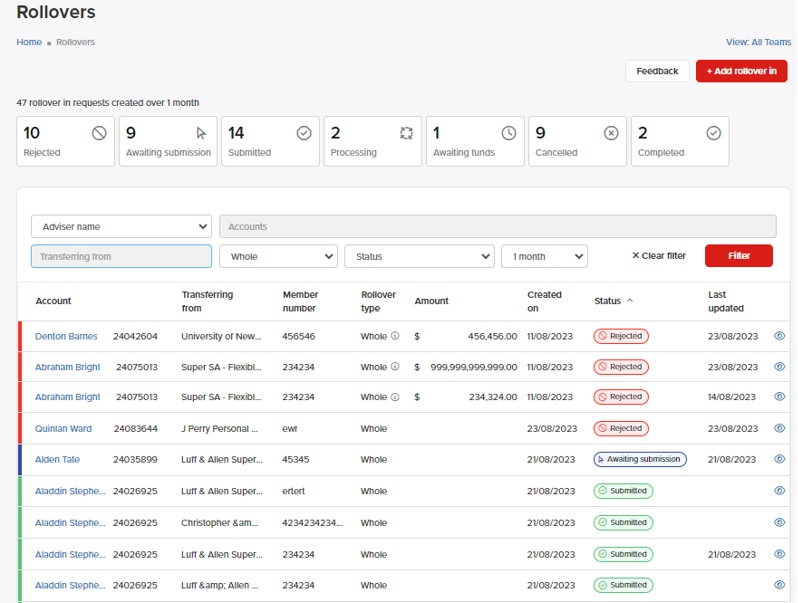

SAVE TIME MANAGING ROLLOVER IN REQUESTS WITH OUR NEW DASHBOARD

16 Oct 2023

We understand that keeping track of client rollover status and chasing client consent for paper-based submissions can be time consuming for your business and inefficient for your clients.

Our new dashboard empowers you with greater transparency and flexibility when managing Rollover In requests for your clients. You can now view the status of your existing rollover requests, modify or cancel existing requests, create new requests, and schedule future requests – all from the same place.

To access the new Rollover In dashboard, simply login to the AdviserHUB and navigate to Accounts > Manage Accounts > Rollovers.

Sep 2023

EMPOWER YOUR CLIENTS WITH GREATER TRANSPARENCY WITH OUR ENHANCED RECORD OF ADVICE TEMPLATE

11 Sep 2023

We’ve made enhancements to our ROA tool by providing more tags to help generate a more detailed ROA template for your clients.

We’ve updated the fee tags to provide more information regarding ongoing and one-off fees. We’ve also added new tags such as Authorised Representative Number and Product Offering which advisers can use and populate data with on their own ROA template.

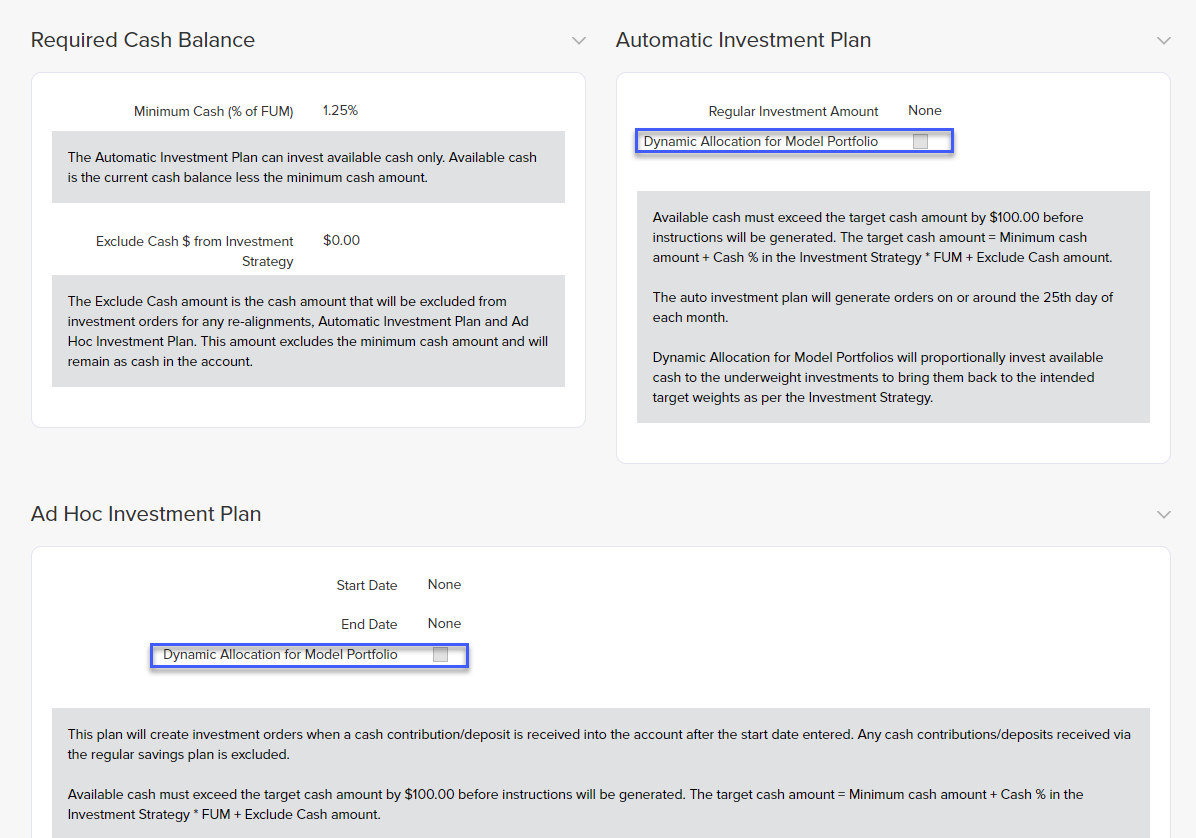

OPTIMISE YOUR INVESTMENT STRATEGY AND CREATE VALUE FOR YOUR CLIENTS WITH DYNAMIC ASSET ALLOCATION

11 Sep 2023

When setting up an automatic investment plan or ad-hoc investment plan, new contributions can now be proportionately allocated to underweighted investments, focusing on those with the most significant variance. This helps keep your clients’ portfolios more closely aligned with intended targeted weights to optimise their investment strategy.

You can select Dynamic Allocation when setting up an Automatic Investment Plan or Ad-Hoc Investment Plan.

ACCESS TIME-WEIGHTED PERFORMANCE REPORTS FOR YOUR CLIENTS

11 Sep 2023

We continue to enhance our market-leading reporting capabilities.2 Based on your feedback, we’ve recently made three new time-weighted performance reports available on AdviserHUB—offering additional reporting choices to support you and your clients. These new reports include a visual representation of account performance, time-weighted return methodology and look-through for managed portfolios. To access, go to the client’s Portfolio Dashboard on AdviserHUB, click on the Account Menu button and select Account Reports.

2 Investment Trends Platform Competitive Analysis and Benchmarking Report 2022

Jul 2023

ADD AUTOMATED FEEDS FOR SELECTED CASH AND TERM DEPOSIT ACCOUNTS¹

15 Jul 2023

Save time and give your clients a complete view of wealth in HUB24 Present and InvestorHUB. Our latest data and technology innovation offers new automated feeds for select cash account and term deposit balances. You will also be able to see these account balances on the Portfolio Dashboard.

1 Automated data connections are now available for Macquarie Cash Management Accounts, Macquarie Cash Management Accelerator Accounts and Macquarie Term Deposits. The Macquarie Cash Management Account, Macquarie Cash Management Accelerator Account and Macquarie Term Deposits are deposit products issued by Macquarie Bank Limited ABN 46 008 583 542 AFSL 237502.

VIEW CUSTOM ASSET SETTINGS IN THE PORTFOLIO DASHBOARD

15 Jul 2023

If you or your licensee choose to create custom asset settings (asset class names, preferred display order, etc.) in HUB24 Present, your customisations will now also appear on the Portfolio Dashboard.

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.