Established in 2022 on Queen Street in the heart of Melbourne, Sonder Advisory Group has a diverse client base that consists of individuals and family groups across all stages of life. Recently, there has been an influx of 20–30-year-olds who have not dealt with a financial adviser before and are trying to build out their financial literacy.

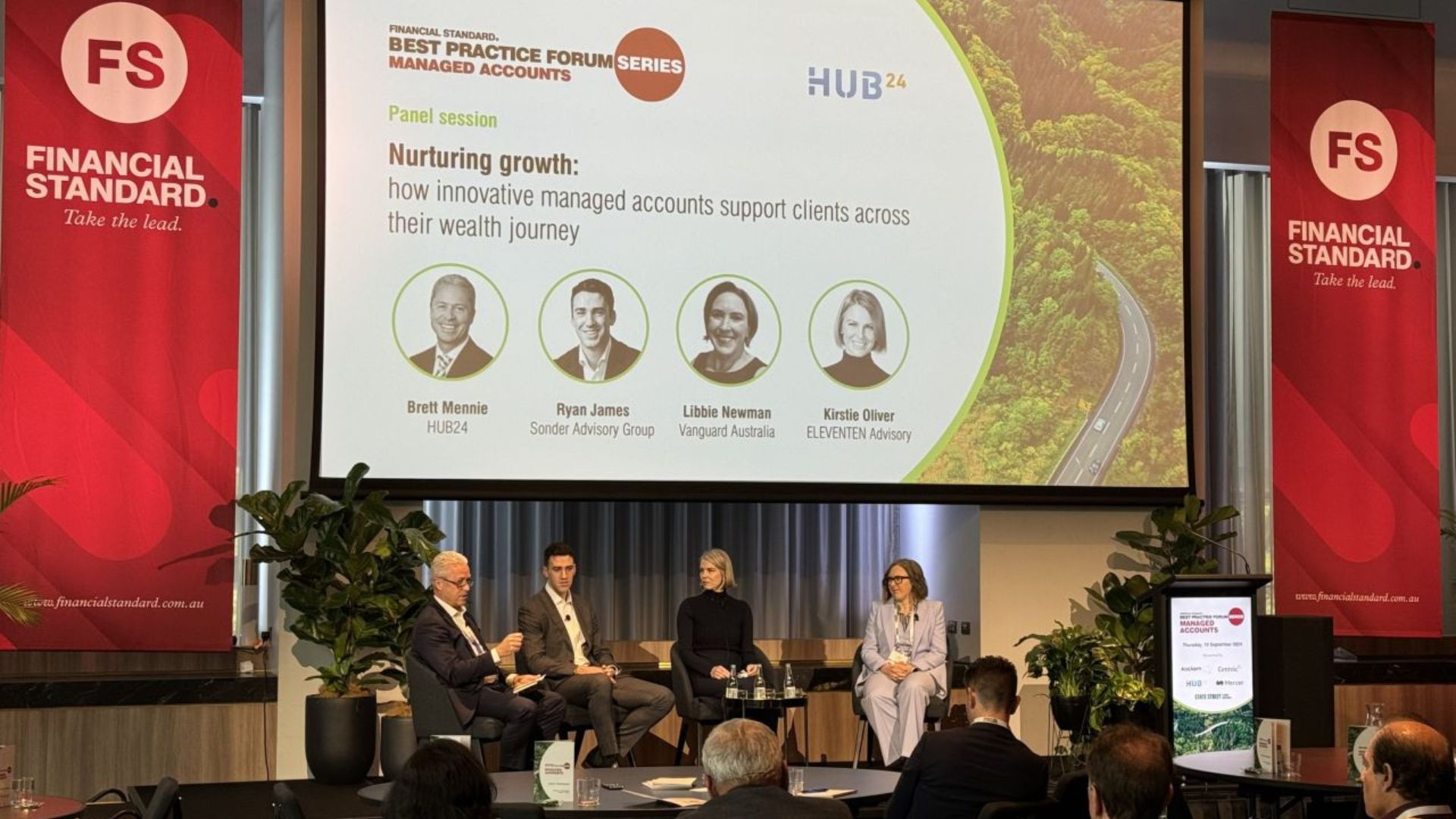

Director and principal financial adviser Ryan James has been working in the industry for the past six years and is one of four financial advisers in the business.

Sonder uses HUB24 Discover to meet a client need for cost-effective investment solutions which utilise managed accounts and is aligned to the businesses focus to be as efficient as possible. It also provides an alternative to industry fund solutions.

“The Discover offer has been a bit of a game changer for us, to look outside of industry funds who have typically held the lion’s share of the market on those smaller balances,” said James.

Further, the engagement and transparency benefit it provides delivers a client experience that is aligned with what the business is trying to achieve.

“The earlier they [clients] take an interest and some accountability, they are going to be more inclined to invest in the future as their comfort level rises over time, so it’s a good starting point.”

Portability is a key issue for his clients who want a long-term approach to their investment journey and to utilise structures that enable this.

“Financial planning is a journey that we are explaining to our client and the Discover offer is a good building block. As their needs change over time, we have that ability to jump in and out of menus without realising capital gains, with a flick of a switch.”

James added, “It’s a great starting point regardless of whether they are a young client or towards the end of their working life.”

While portability offers the benefits of making changes as needs change, there is still the desire to get the right structures in place from the start.

“If you get it right from the start you are not forced to sell out of platform if investments get too expensive. If you get the bones of it right, it leads to good outcomes.”

With older clients taking more interest in their super, transparency and access via the App are also features of the offer.

“Setting up accounts in five minutes, gets you off to a good start with clients.”

Using a wrap platform from the start has helped Sonder engage clients with smaller balances and servicing them is about demonstrating how much value they can provide now and preparing for their client’s situation to change in the future.

“They may not be an ongoing client now, but in two to five years they might be.”