Managed portfolios are becoming essential for delivering multi-generational advice, providing a broad range of benefits across age groups and client types, enabling advisers to tailor investment solutions to individual needs.

Insights

- Financial advisers regard managed portfolios as flexible investment solutions that suit clients at any stage of life, regardless of net worth.

- Intergenerational wealth transfer requires advisers to take a multi-generational approach to advice and to establish investment strategies that are suitable for clients with complex and less complex needs.

- HUB24 Discover is helping advisers access the advantages of managed portfolios within a cost-effective structure.

Regardless of a client’s stage of life, managed portfolios are proving an efficient way for financial advisers to deliver multi-generational financial advice.

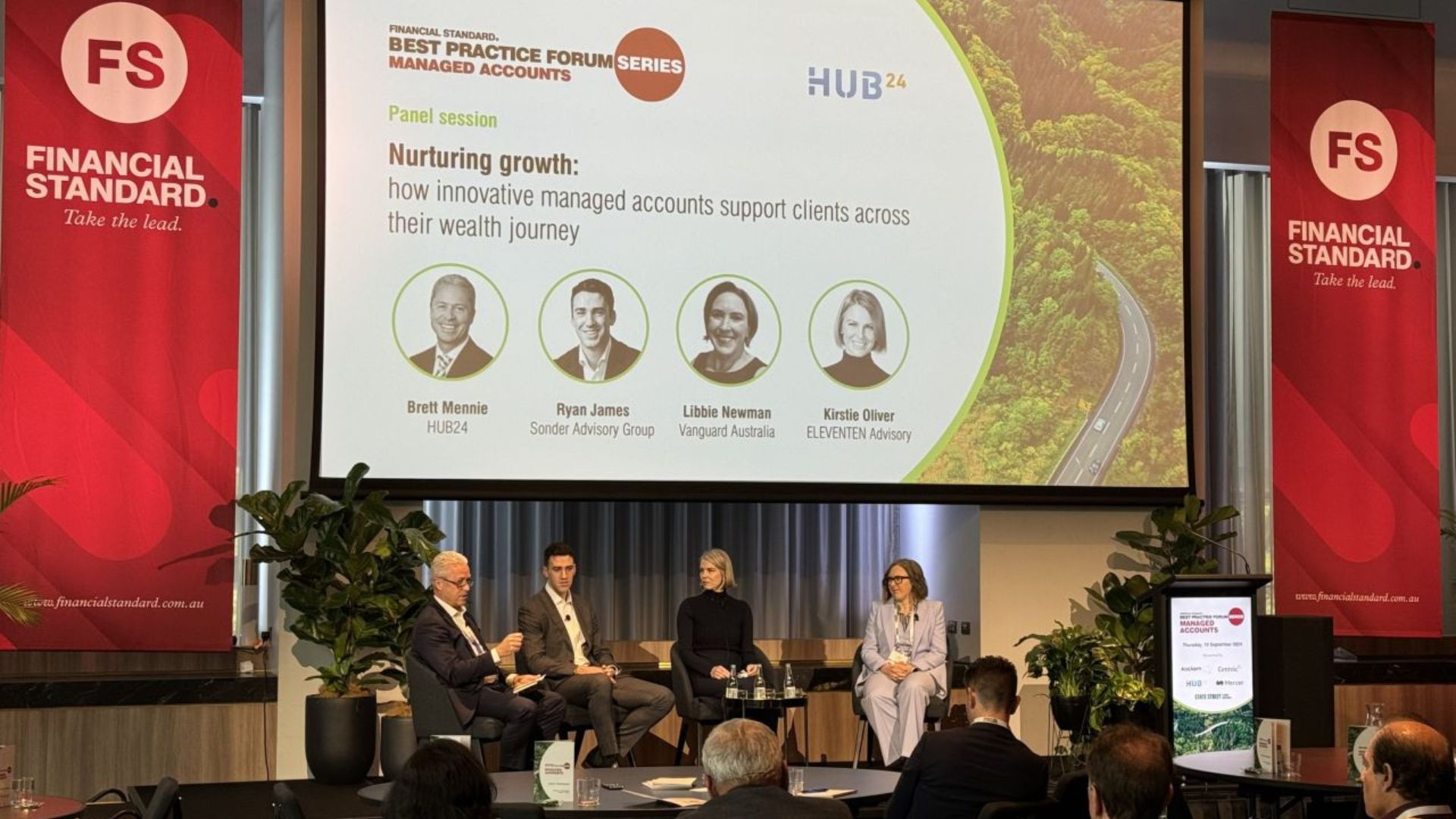

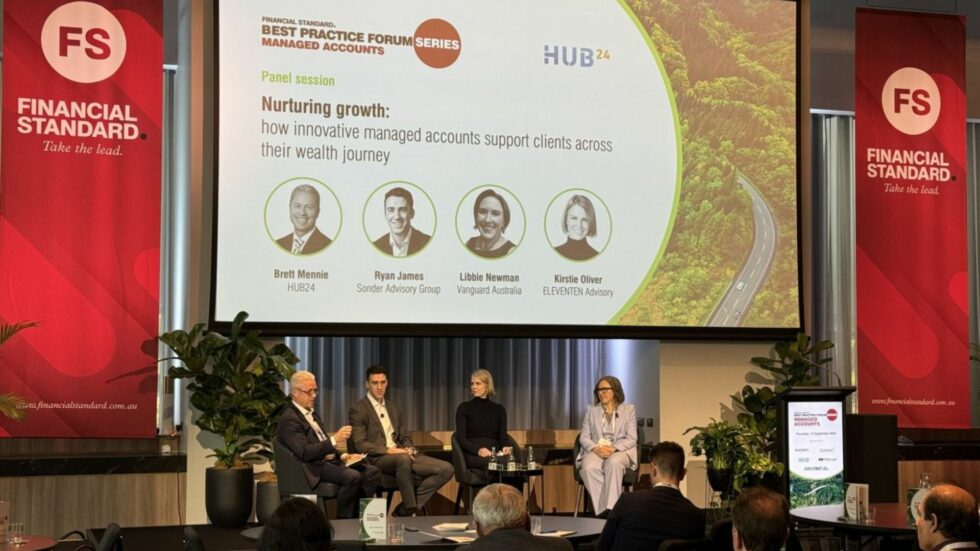

At the recent Managed Accounts Forum, HUB24’s Head of Managed Portfolios Brett Mennie joined Sonder Advisory Group’s Director and Principal Financial Adviser, Ryan James and ELEVENTEN Advisory’s Director, Kirstie Oliver to discuss how they are using HUB24 Discover with their clients.

Launched in 2023, HUB24 Discover provides financial advisers and their clients with access to a streamlined list of managed portfolios from a range of investment managers, and a competitive simplified fee structure on HUB24’s award-winning platform.

James and Oliver agreed that whether clients are 20 or 55-year-olds, Discover is enabling them to not only service their individual needs but to focus on an investment journey.

“Regardless of stage of life, Discover has met a need,” said James. “It is cost-effective and provides us with managed accounts which align with our client needs.”

Sonder Advisory Group has found by using Discover, it can provide clients with further transparency, enhancing the investment journey to drive greater client engagement.

“We are trying to be efficient and also allow clients to go on the investment journey, so instead of being lumped in the balanced fund or the high growth fund, they can actually look through their portfolio and they’re taking some interest in it,” said James.

Over the past five years, Oliver’s business has direct experience of intergenerational change following the passing of some of her elderly clients and the emergence of the next two generations in the same family, where their children are aged 55-65 years, and their children are now in their mid-twenties.

Although ELEVENTEN Advisory’s target market includes specialist medical professionals, Oliver said it doesn’t make sense to ignore the financial needs of their broader family unit.

“We have put all this time and effort into wealth and legacy and all this time talking about family values and succession planning, it’s not really justified if we just forget to engage that next generation.”

Oliver said this engagement is quite natural as in many cases, the children have Power of Attorney and they are engaging with the financial planner, in many ways, out of necessity.

“I don’t believe we should be engaging with them when someone has passed away. I believe we should have been engaging with them for many years prior to that.”

At the other end of the age spectrum, both advisers say Discover also provides a flexible solution for pre-retirees because as their super balances grow, they are looking for options on what they want to do when they retire.

Further, it offers advisers more options when considering the needs of different generations who have different superannuation balances.

For example, Oliver said when she is assisting clients with transitioning to retirement strategies it can be hard to develop strategies when there maybe a $10-$20k balance in one account and $2 million in another account. In these cases, and for accounts with smaller balances, advisers can use a passive strategy and keep the account fee at zero.

Meanwhile, for elderly clients who may be earning 11-13% per annum on their investments and not spending as much, Discover provides investment options for these funds that can sit alongside their pension account, rather than having pension payments simply accumulating in a cash account.