ELEVENTEN is based in Carlton, Melbourne and caters to high-net wealth families including specialist medical practitioners working in the area. The average client is closer to 50-years of age, from established wealth and has complex strategic advice needs. Whilst not a focus of the advice, the client profile typically holds balances well in excess of $1 million outside of property and superannuation to invest.

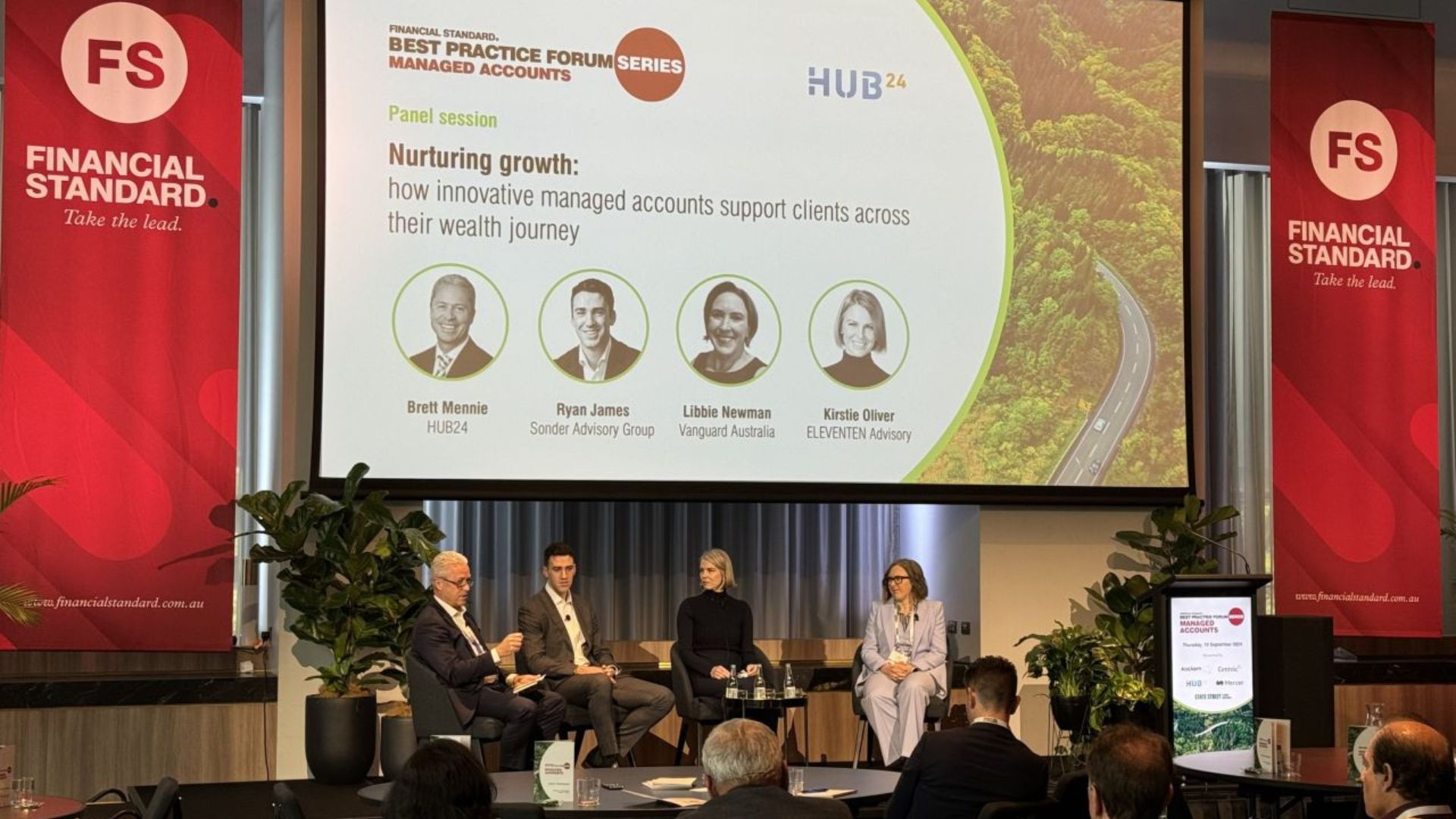

Financial Adviser Kirstie Oliver said the business offers a strategic advice model centred around creating fit for purpose investment solutions for the client.

Superannuation activities such as end-of-financial-year planning, super contributions and splitting are all in a normal day’s work for the business, and therefore utilising innovative platforms such as HUB24 that offers a range of solutions to meet the needs of various client types is important.

“When their whole financial universe exists and works and then you’ve got this satellite holding that just becomes a pain point to report on, that’s when the solution to come back to HUB24 makes sense.”

Oliver’s business is using HUB24 Discover when implementing estate planning for clients who have children and grandchildren to consider.

It is proving particularly useful with trust distributions for younger family members where they can be used as an initial seed investment to then top up with further distributions over time.

As these investments with smaller balances grow to become larger account balances, clients can transition through the investment menus, enabling portability and the flexibility in investment needs.

This provides the client with investment flexibility whist also maintaining their engagement and relationship with their adviser as their needs change.

Oliver said Discover is also valuable in the provision of multigenerational advice, because in a situation where an older client passes away, its low-cost structure enables an adviser to spend the time they need to focus on the strategy work while delivering value.

“The value is weighted towards the account holder, and it frees up space to charge a time cost fee in order to do the strategy advice justice and for our practice to be appropriately paid for that.