Want to know more? Access the full whitepaper The Future of Managed Portfolios click here.

Technology has already moved on considerably from the first iterations of managed portfolios.

Now, providers allow a much higher degree of automated portfolio management, and new solutions and new services are being added consistently. Innovation is constant, and it won’t stop.

The early iterations of master trusts and wraps delivered solutions to advisers and clients unlike any seen before. But the pace of change and improvement in technology means those initial offerings have often struggled to remain relevant and to match the efficiency of newcomers to the market – and just keeping up to date has often involved the investment of tens or hundreds of millions of dollars.

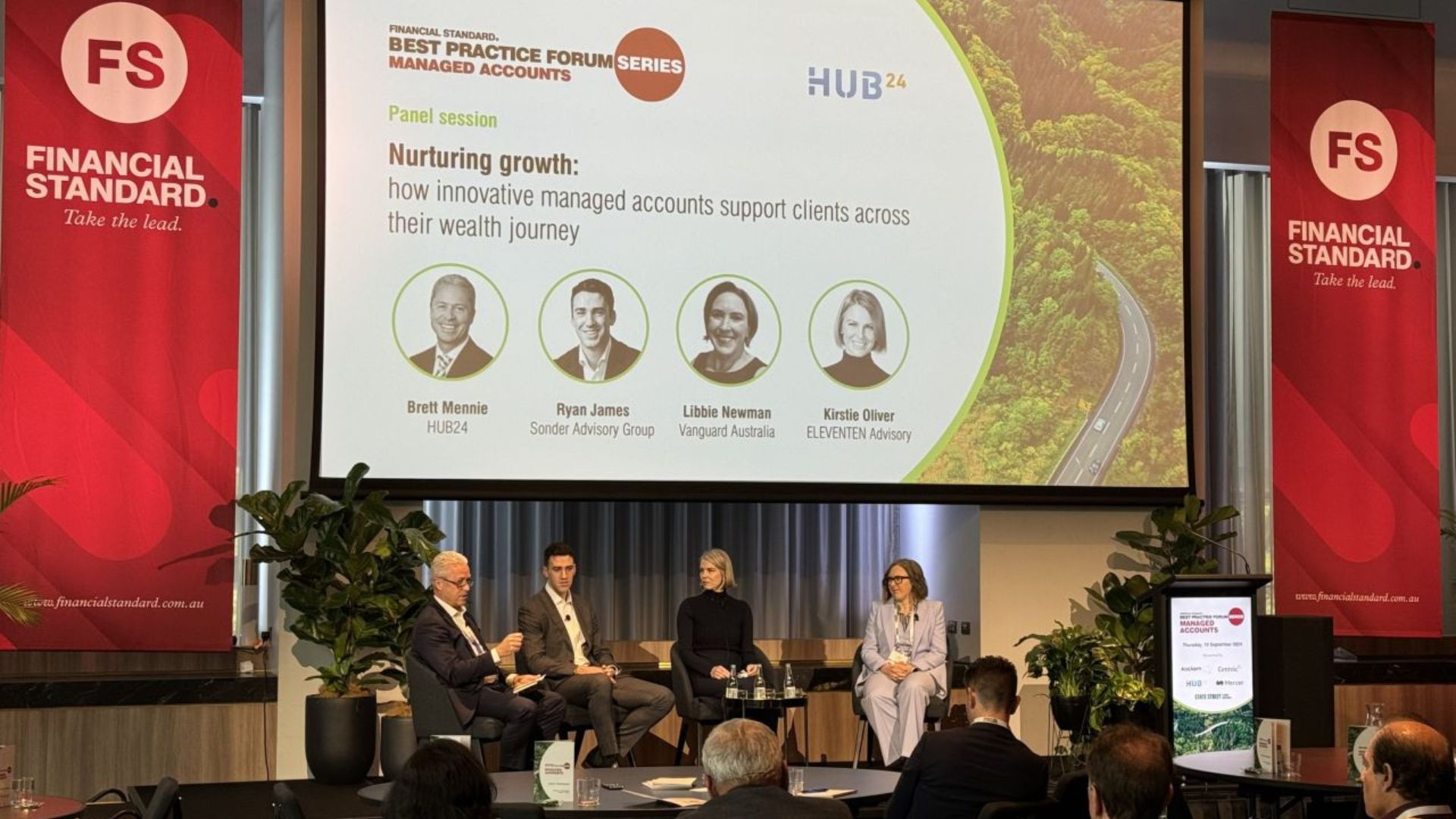

‘You want to be partnering with a provider that is committed to continuing to invest in technology that will provide better outcomes for clients. Putting a shingle up and saying “we’ve got managed accounts” is not enough, there’s a lot more you need to look at behind that, including the actual functionality and plans for its future’

Jason Entwistle, Director Strategic Development, HUB24

In some respects, the solutions offered by the first wave of platforms now look quite quaint, but ongoing and relentless improvements mean that managed portfolios have unquestionably become a core part of an adviser’s tool set.

The technology underpinning the current crop of managed portfolio offerings is industrialising the provision of robust, flexible, and tailored investment solutions by advisers to clients, whilst leveraging beneficial ownership to achieve tax benefits and simultaneously reducing costs. Innovation in features and services is only increasing as platforms become more technically capable.

Improvements in platform technology create some additional issues for advisers: if solutions exist that enable them to customise portfolios and deliver highly personalised investment solutions to clients, with the ultimate aim of delivering better investment outcomes, then those benefits must not be stymied through related investment issues such as implementation leakage, and by other advice practice inefficiencies.

Fortunately, the latest thinking by the market-leaders in managed portfolio implementation is addressing these issues, offering solutions to enable advisers to execute transactions and rebalance portfolios efficiently, and to harness the insights and big-data analytical potential of platform providers to engage more efficiently and constructively with clients.