HUB24 for Investors

Delivering innovative solutions to empower better financial futures, together with your financial adviser.

Welcome to HUB24. You may have landed here through a recommendation from your financial adviser. Take a few minutes to watch the video and understand why advisers like yours have voted us Australia’s Best Platform, and how alongside your adviser we can empower a better financial future for you.

Who is HUB24

The HUB24 platform is a part of HUB24 Limited, an ASX 100 listed company that leads the wealth industry as the best provider of integrated platform, technology and data solutions. Our platform is recognised by financial advisers and the wealth industry as Australia’s best platform and administers over $87 billion .1,2

We believe in the value of advice and enabling accessible advice to more Australians. That’s why we’re committed to delivering innovative solutions to meet your super, pension, investment and insurance needs.

Broad range of investment options

We’re collaborating with leading Australian and international investment managers to offer you with a broad range of investment options on HUB24 Invest and HUB24 Super. By working with your adviser, you can tailor investments to meet your individual needs.

Discover menu

Our Discover menu provides cost-effective access to a streamlined selection of managed portfolios by leading portfolio managers. This menu may suit early-stage wealth accumulators, later stage retirees, and anyone with less complex investment needs.

A selection of managed portfolios from 8 managers with the benefit of no administration or account keeping fees, backed by award-winning managed portfolio functionality.1

HUB24’s cash account is a transaction account that supports the broad range of services provided to your clients, including investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Core menu

Our Core menu provides access to a wider range of investment options, with the benefit of lower minimum administration fees. This may be a great option for clients – including SMSF Access clients – who have a lower account balance or straight forward investment needs.

In our Core Menu, we offer a selected range of multi-sector portfolios, backed by award-winning managed portfolio functionality.1

90-day, 180-day and 365-day term deposits from a range of providers.

HUB24’s cash account is a transaction account that supports the broad range of services provided to clients of the platform, for example investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Choice menu

Our Choice menu provides a full suite of investment options, allowing greater choice and flexibility. This menu may suit clients – including SMSF Access clients – with a larger account balance who would like to benefit from our full range of investment options.

Access a wide range of multi-sector and single-sector portfolios, backed by award-winning managed portfolio functionality.1

Choose from a list of over 1,000 managed funds from more than 50 Australian and International fund managers.

Your clients can invest directly in Australian listed securities including listed shares, exchange-traded funds, other exchange-traded products, listed investment companies, interest rate securities and hybrids (such as preference shares and convertible notes).

Your clients can invest directly in a wide range of international listed securities from more than 15 international exchanges across the US, Asia and Europe, including an extensive range of US-listed ETFs.

90-day, 180-day and 365-day term deposits from a range of providers.

HUB24’s cash account is a transaction account that supports the broad range of services provided to clients of the platform, for example investment trading, portfolio rebalancing, the payment of fees, insurance premiums and pension payments. Interest is calculated daily and paid monthly on any positive balance in your clients’ cash accounts.

Insurance options from leading insurance providers

Our insurance options are designed to meet your various needs and support comprehensive financial planning.

Group Insurance Options

Group insurance offers competitive premiums based on group rates and other benefits, such as the ability to choose from ‘Standard’ or ‘Tailored’ Cover depending on your needs.

Individual Insurance Options

We offer individual insurance options from AIA (Priority Protection), Zurich (Wealth Protection and Active), and TAL (Accelerated Protection) through HUB24 Invest and HUB24 Super.

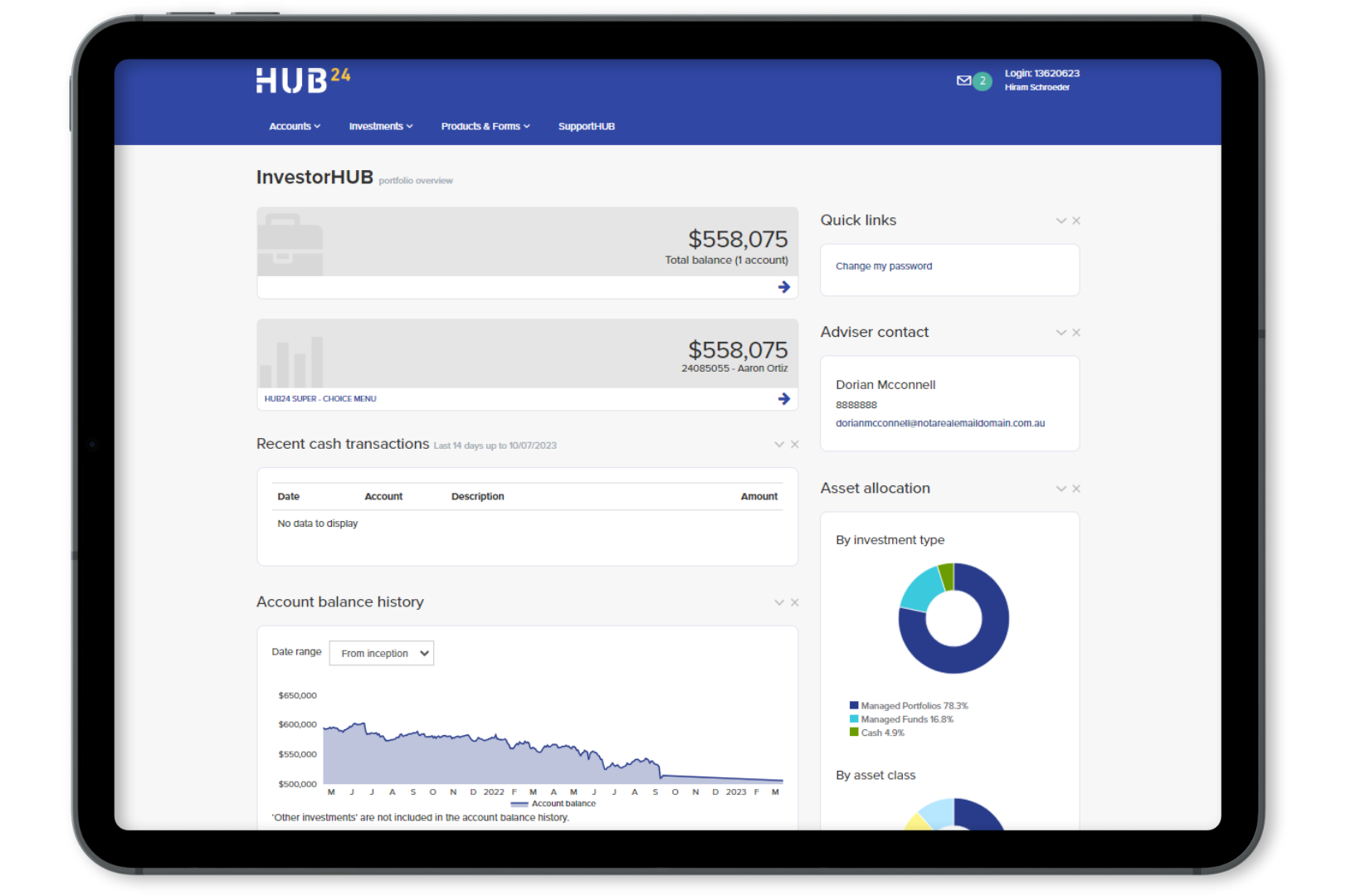

InvestorHUB

Our client portal, InvestorHUB, empowers you to stay connected, and take better control of your investments – all in one place.

Easily access a wide variety of reports and e-statements through our simple-to-use online portal via your desktop or mobile device. To view your account reports and e-statements, head to the Account Menu from your Portfolio Dashboard.

Access InvestorHUB via your desktop or mobile browser. You can also download our free mobile app via the Apple App or Google Play store.

Protecting your data

You are entrusting us with your data, and we take it seriously through a proactive approach to protecting you from potential cyber threats.

We continue to invest to enhance our cyber security controls as outlined by Australian Cyber Security Centre, and we maintain ISO27001 Data Security certification, an international standard for information security. In addition, we offer Multi-Factor Authentication (MFA) on our investor and adviser portals, an additional security layer to your account.

Importantly, we will never contact you regarding potential investment opportunities. If you are contacted by someone you suspect is not legitimate, we encourage you to contact your financial adviser or call us directly on 1300 854 994.

HUBempower

We’re committed to empowering better financial futures, together. One of the ways we make this happen is through HUBempower, our community giving program, which supports a range of non-profit organisations and enables our people to contribute through skills sharing, volunteering and employee gift-matching.

Our approach to giving is underpinned by our values to enable our clients, create possibilities, deliver with integrity, and succeed as one, with the goal of doing the right thing by the communities in which we operate.

Our community partners

The Pro Bono Financial Advive Network (PFAN) is a trusted network of professionals helping Australians living with a personal health crisis, to improve their financial wellbeing through the provision of pro bono financial advice. As a corporate partner, we provide financial support in addition to Board members, skills sharing and networking opportunities to enable PFAN to drive awareness and recruit financial advisers to joing the nework.

The Smith Family helps young Australians to overcome educational inequality caused by poverty. As a new corporate partner, HUB24 supports the organisation’s Digital Learning Essentials program, enabling students to become digitally included with a reliable device, internet access, digital skills and tech support. In FY24, HUB24 supported the distribution of 64 ‘Digital Learning Essential packs’ for the Digital Learning Essentials program, helping young Australians overcome the digital divide and achieve their potential.

Cape York Partnership is a non-profit Indigenous organisation empowering people of Cape York to choose a life they have reason to live. HUB24 supports the Cape York Leaders Program enabling two students from the region to access the life-changing benefits of tertiary education.

FICAP’s (FInancial Industry Community Aid Program) goal is to support ill or disadvantaged young people and their families. As a financial services industry parter, HUB24 enables FICAP’s fundraising activities that support a range of charities which benefit young Australians and their families.

HUB24 is a long-term supporter of Save a Child’s Heart is a non-profit organisation with the mission of improving the quality of paediatric care for children in developing countries.

Frequently asked questions

HUB24 Custodial Services Limited is the primary custodian, Operator, Administrator and Promoter of the award-winning HUB24 investment (HUB24 IDPS) and superannuation (HUB24 Super Fund) platform. HUB24 holds your assets in trust, on your behalf, for safe keeping, as part of our custodial services.

HUB24 Custodial Services may outsource custodial functions for the platform to third party sub-custodians to hold the assets in your account within the IDPS and Super product. HUB24 and the sub-custodians are obliged to use your assets only for the purposes permitted under the terms of HUB24 Invest and HUB24 Super.

Although you’re the beneficial owner of your assets, the legal interest is held by the appointed sub-custodians. This arrangement helps us administer your investments more efficiently and reduce most of your paperwork. If there’s a corporate action, we may contact your adviser who can pass on your instructions to us. Generally, we’ll exercise any rights in relation to your listed securities, including receiving shareholder benefits such as discount cards, attending meetings or voting.

HUB24 Custodial Services Limited does not offer securities lending, and your assets can’t be used for this purpose.

HUB24 Custodial Services Ltd, ABN 94 073 633 664, AFSL 239 122 (HUB24) is a wholly owned subsidiary of HUB24 Limited (ABN 87 124 891 685) which is a publicly listed entity on the Australian Stock Exchange (ASX code HUB).

No, your assets are held in trust for you and are separate to the HUB24 Limited company assets.

No, the performance of your investments in held on the HUB24 platform isn’t linked to the HUB24 Limited share price or any of its subsidiaries.

HUB24 is not aligned to any investment managers or other product providers. HUB24 is committed to offering a broad universe of investments via the HUB24 platform. This ensures we remain impartial to the investment managers, insurers and other product providers who use HUB24.

HUB24 Custodial Services Limited, and our sub-custodian, publish either a GS007 or an ASAE/ISAE 3402 which is an independent assessment of their internal controls and can be made available on request to existing customers. They are also recognised leaders in the services they offer.

Resources

1 HUB24 was rated Best Platform Overall, Best Managed Account Functionality, Best in Online Business Management, Best in Reporting and Best Mobile Platform in the 2023 Investment Trends Platform Competitive Analysis and Benchmarking Report.

2 HUB24 Q1 FY25 Market Update, HUB24 Platform FUA as of 14 August 2024.

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 was rated Best Platform Overall, Best Managed Account Functionality, Best in Online Business Management, Best in Reporting and Best Mobile Platform in the 2023 Investment Trends Platform Competitive Analysis and Benchmarking Report.