A case study

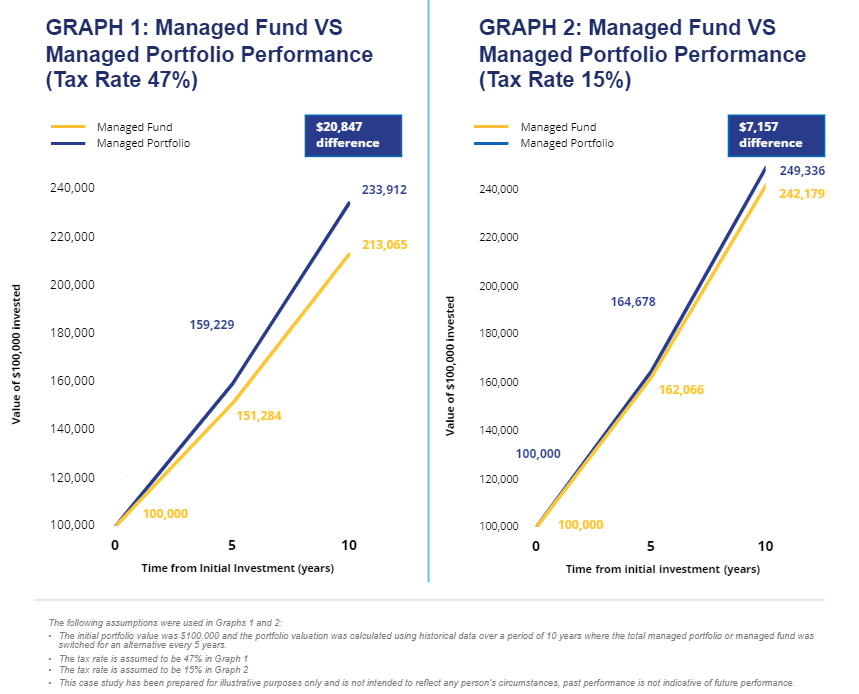

This case study was modelled using actual managed portfolios and managed funds available on the HUB24 platform. The portfolio and subsequent rebalancing were simulated. Please read the reliance and limitation statement here.

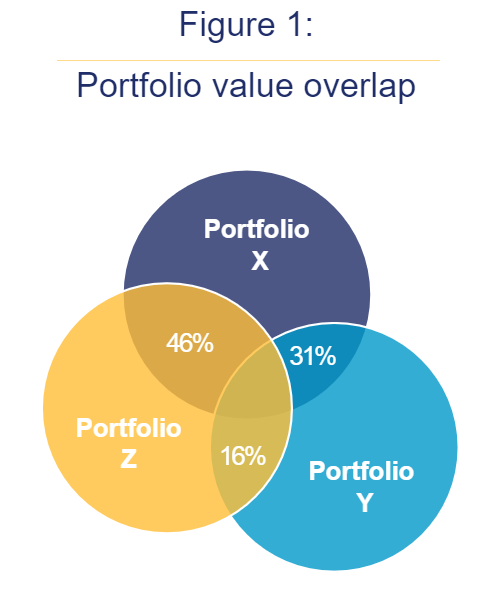

In 2010, Client A invested $100,000 in an Australian equities managed portfolio available on HUB24 (Portfolio X). In 2015, Client A’s adviser recommended switching to an alternative Australian equities managed portfolio (Portfolio Y) and switching again five years later to a different managed portfolio (Portfolio Z). For comparison purposes, we modelled the same scenario for Client A using Australian equities managed fund alternatives.

For Client A with managed portfolios on HUB24, only shares that are different between two managed portfolios are bought or sold. This minimises CGT and the client only incurs the cost of the buy/sell spread and transaction fees on a subset of the managed portfolio. If Client A had used unitised managed funds, the same scenario would have resulted in a complete sell down of units in the managed fund and repurchased of units in the new fund, which would trigger a CGT event and transaction costs on the buys and sells.

It is worth noting that during the COVID-19 market volatility, buy/sell spreads widened significantly due to the increased volume of switching and trades in the market over noticeably short timeframes, resulting in greater costs for clients who were engaging in switching.