Dispelling the $500K myth

ASIC guideline changes demonstrate that the starting balance of a SMSF is just one of a range of factors a financial adviser should consider when determining the suitability of an SMSF for their client. According to ASIC, there may be circumstances where an SMSF with a low starting balance is consistent with the client’s best interests.

Read ASIC media release here.

In 2022, the Australian Securities and Investments Commission (ASIC) updated its guidance on the provision of SMSF advice with the publication of Information Sheet 274 Tips for giving self-managed superannuation fund advice.

ASIC undertook a review of its guidance on SMSF advice. This included the statements about SMSF balances as well as the performance comparisons of SMSFs compared to APRA-regulated funds.

ASIC concluded that superannuation balance, whether high or low, while important, is only one factor when considering whether an SMSF is suitable for a client. Other important factors include the risks and costs associated with setting up and/or switching to an SMSF, investment strategies, diversification, liquidity, asset choice, trustee responsibility and time-commitment and the potential benefits of professional advice when deciding to set up and/or switch to an SMSF.

How much money does your client need to set up an SMSF?

Read information sheet here.

As noted, the starting balance of an SMSF is one of a range of factors you should consider when recommending an SMSF for your client as this is relevant to the cost-effectiveness of an SMSF.

There may be circumstances when an SMSF with a lower starting balance is consistent with your client’s best interests.

Examples include if:

- The trustee is willing and able to undertake much of the administration and management of investments to make it more cost-effective, or

- A large contribution will be made into the SMSF within a short timeframe (such as within a few months) after the fund is set up.

There may be circumstances when an SMSF with a higher starting balance is not in your client’s best interests because it does not meet your client’s objectives, financial situation or needs.

Read University of Adelaide report here.

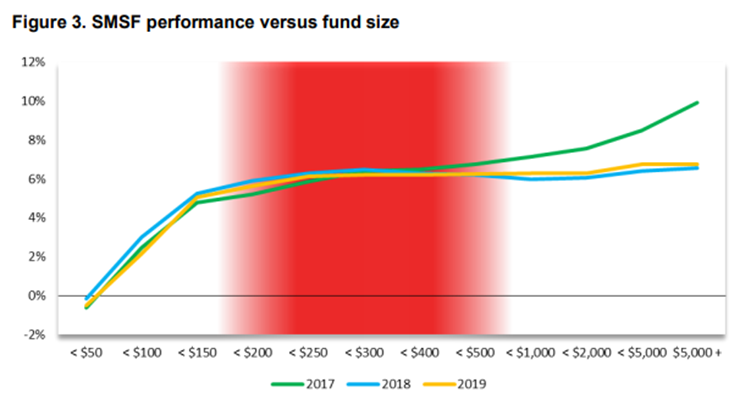

To support ASIC’s decision, we can refer to the finding in the 2020 joint venture research report from the SMSF Association and the University of Adelaide’s International Centre for Financial Services. The research builds on the results presented by the Productivity Commission (2018) relating to SMSF performance and is a key extension for correcting the incompatibility in investment performance metrics between SMSFs and Australian Prudential Regulated Authority (APRA) funds.

Based on the previous research, the Productivity Commission (2018) stipulated that “…many smaller SMSFs (those with balances under $500,000) have delivered materially lower returns on average than larger SMSFs”. This recommendation was then adopted by the ASIC as guidance for Australian financial services licensees (and their representatives) who provide advice to retail clients about SMSFs. The University of Adelaide (Feb 2022) research study examines the link between the size of SMSFs and their financial performance and offers some simple evidence on how the relationship appears to have changed in recent years.

Figure 3 shows there is a strong positive relationship between fund size and fund performance overall (if we consider the full range of fund sizes from funds smaller than $50,000 all the way up to funds larger than $5 million). This relationship is also stable over time, holding for all three years in the sample.

Taken together, these results support the regulatory focus on fund size, but also suggests that the ASIC guidelines around minimum SMSF balances might be poorly calibrated. Specifically, there is little to no support for the notion that funds with balances below $500,000 should be singled out as poor performers.

The research allays concerns around the critical mass for opening balances. The results indicate that, insofar as it relates to fund size, people should have confidence in their performance prospects anywhere upward of $200,000 in net assets.

The notion that SMSFs with balances under $500,000 deliver materially lower returns, on average, than larger SMSFs, is not supported by the evidence presented. The results suggest that it is more appropriate to calibrate this threshold at $200,000.

Are SMSFs affordable?

Read Rice Warner report here.

According to a research study by Rice Warner (Dec 2020), since 2013, fees and costs have changed across the superannuation market. In general, the costs of services to SMSFs have fallen whereas in the APRA regulated market, the fees of Industry Funds have risen while the fees of Retail Funds have fallen to align with those of Industry Funds. The result is that SMSFs are more competitive than they were in 2013, but still have a very wide range of potential costs so their suitability needs to be considered carefully.

Revised recommendations are:

- SMSFs with less than $100,000 of assets are not competitive with APRA regulated funds. SMSFs of this size would only be appropriate if they were expected to grow fairly quickly.

- SMSFs with between $100,000 and $200,000 of assets can be competitive with APRA regulated funds provided the Trustees use the cheapest service providers and/or undertake a number of administration services themselves.

- SMSFs with more than $200,000 of assets can be competitive with APRA regulated funds even where the Trustees outsource all administration functions, provided they use one of the cheaper suppliers.

- SMSFs with asset values of $500,000 and above are generally the cheapest alternative.

The analysis highlights that SMSFs that do not invest in direct property or use complex investment structures like gearing are cheaper to administer, probably due to simpler accounting and auditing, have lower investment costs. These differences are important.

The range of service offerings used by SMSFs and the wide range of their costs means that a simplistic focus on the size of their asset holdings is an inadequate and insufficient approach to assessing whether a particular Trustee has received appropriate advice. A more nuanced approach is definitely called for when seeking to determine whether an SMSF is in the best interests of members:

- The costs of investing in complex assets should not be held over those who do not invest in these assets.

- An SMSF with a modest balance invested in listed instruments by the Trustee directly is not in the same position as an SMSF with the same balance invested via an expensive portfolio management service.

- Even if starting small, will the SMSF grow within a reasonable time frame. If the intention is to move to an SMSF, for those able to make large contributions, there are tax advantages to moving with a smaller balance rather than waiting for a larger balance in a few years.

- An SMSF does not have to be the cheapest option to be competitive.

- The presence of insurance, its coverage and costs, is dependent on the personal circumstances of members irrespective of the size of the asset pool.