ESG – SMSFs empowering responsible investing

We explore the importance of choice and control inherent in SMSFs and how these factors are driving demand from younger people. We also highlight the increasing importance of sustainable investing amongst this cohort and the benefits of using a SMSF to achieve this.

Read Self-managed superannuation offers choice and control…and more young people want it here.

Summary:

- Control has been a long-held attraction of SMSFs. Although managing your own superannuation does entail responsibilities and obligations (many legally enforceable), it comes with the benefit of having greater engagement with and understanding on how your superannuation is being invested and performing.

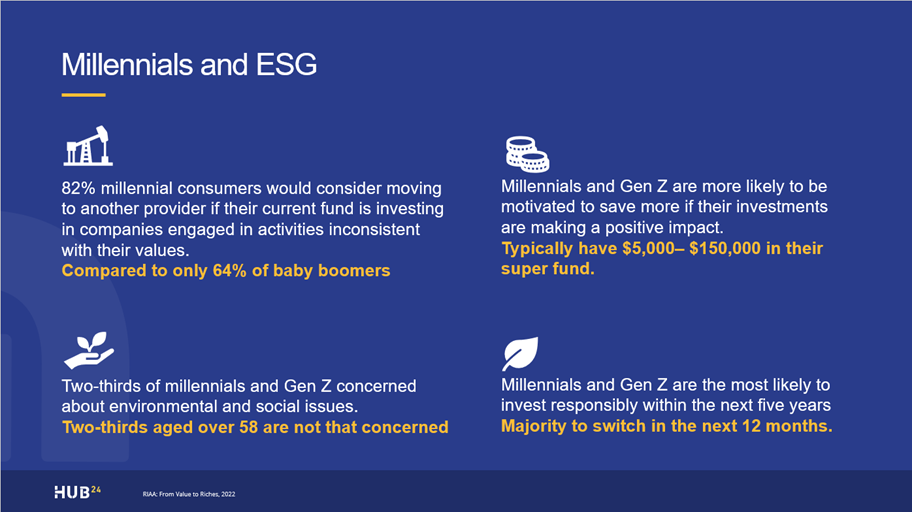

- Today, SMSFs are not just for older Australians. Although three-quarters of SMSF members are aged between 50 and 84, Australian Tax Office data shows a higher growth rate in new establishments among a younger cohort, with the 35-44 age group providing 34 per cent of all SMSF establishments in the March 2023 quarter.

- This new generation of SMSF members not only like having control but want clear visibility about how their superannuation is invested. Ethical and sustainable investing are important considerations for this generation and an SMSF allows them to achieve this.

Read Advice Practice Management Series: Investing for the future, with clients of the future here.

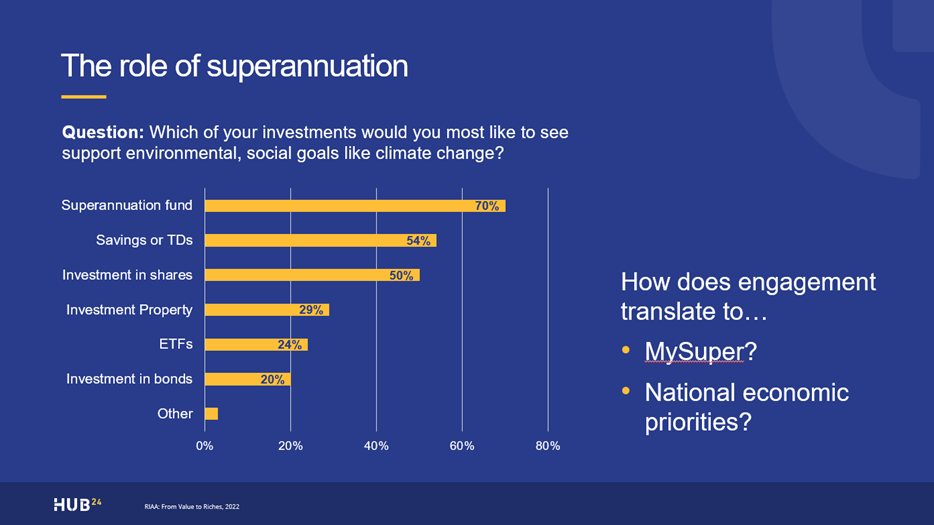

According to research from the Responsible Investment Association Australasia (RIAA), 83% of Australians expect their super to be invested responsibly and ethically, and 80% expect their savings to have a positive impact on the world.1

Companies and investment managers are responding to bottom-up pressure to report on their sustainability metrics, and top-down pressure from regulatory bodies such as the ASX, ASIC and APRA to ensure products are labelling themselves truthfully as the pool of responsible investments continues to grow.

64% of Australians expect their financial adviser to be knowledgeable about responsible investment options. This has increased from 54% in 2020 and is now the number one expectation that Australians place on financial advisers – even prioritised over investment returns.1

Advisers who provide ESG advice are reporting a better rapport with their clients by being able to align their clients’ values with their investments. Exploring topics that clients feel passionate about and discussing their personal values, instead of just their desired financial outcomes, allows for deeper conversations and increased engagement. This can help to build stronger and more trusted relationship.

Clients with responsible investments also tend to be ‘stickier’ and ride out market volatility. Clients who choose these types of investments generally have a good understanding of the long-term nature of ESG investments and are willing to ride out short-term fluctuations. Almost two-thirds of clients (64%) agree that responsible and ethical investments perform better in the long term.1

Environmental issues are the primary concern for clients who currently hold ESG investments – rating above corporate governance, ethical, social and Indigenous issues. Over the past year, 54% have bought or sold ESG investments based on environmental considerations.3

Responsible investing, as benchmarked by RIAA, now makes up over 40% of all professionally managed assets in Australia.2

1 Responsible Investment Association Australasia, From Values to Riches 2022: Charting consumer demand for responsible investing in Australia, 2022.

2 Responsible Investment Association Australasia, Responsible Investment Benchmark Report Australia 2022.

3 Investments Trends, Investment Trends 2022 ESG Adviser Report, May 2022.