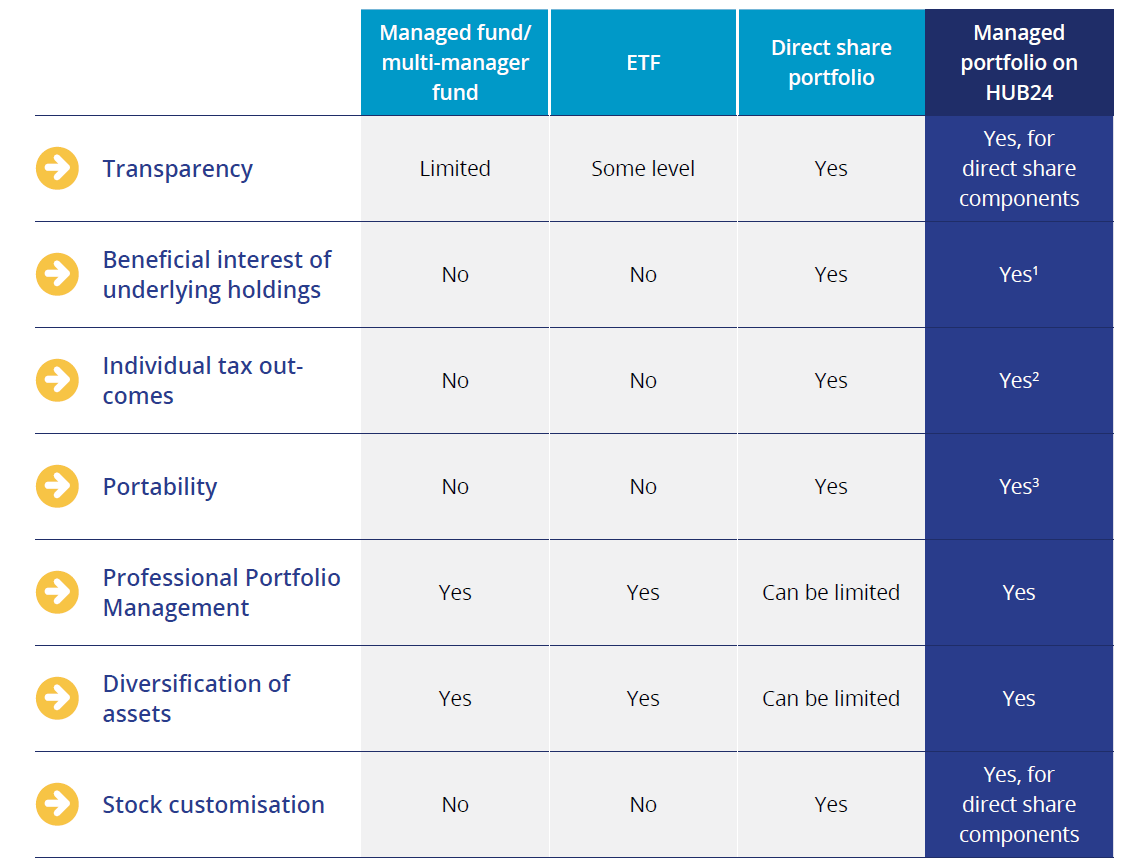

How do managed portfolios compare to other traditional asset structures?

Managed portfolios can combine some of the benefits of investing directly with professional investment management, within a structure that may be more cost effective and efficient than investing in shares or managed funds directly.

- Client typically retains beneficial interest of the underlying securities in the managed portfolio held in investment accounts and the Trustee retains these benefits for the client in superannuation accounts.

- Tax outcomes vary between Investment and Superannuation accounts.

- Assets may be integrated into (or out of) a HUB24 managed portfolio without the need to sell and repurchase.