Managed portfolios: A new way of doing things

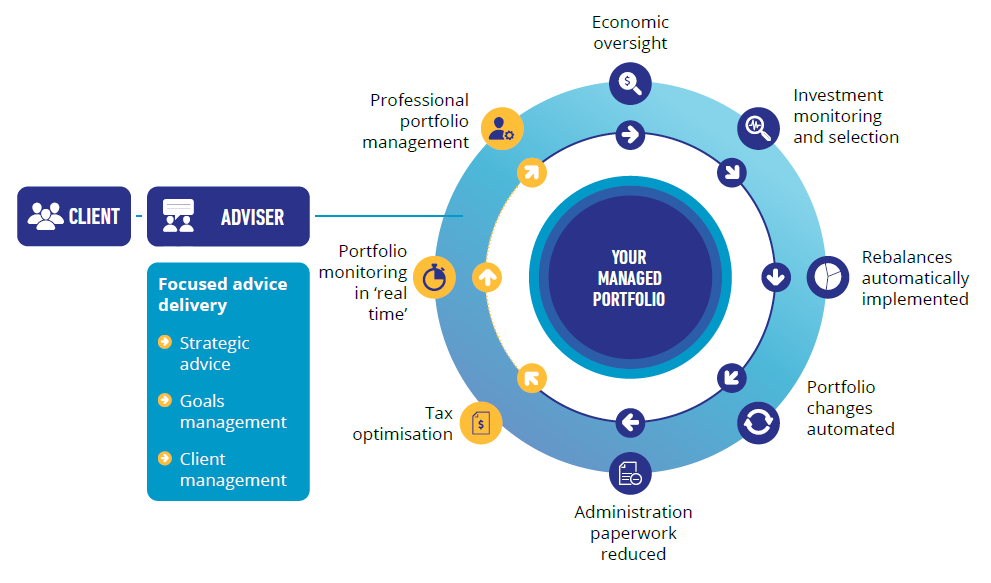

Managed portfolios, through sophisticated development of technology, have enabled the advice process to evolve – saving you and your client’s valuable time. By investing through a managed portfolio, your client’s portfolio will be managed in-line with the investment strategy of the portfolio manager chosen to manage their assets. Advisers have seen this as a way of strengthening, in-sourcing and industrialising their investment capability and offering, while delivering administration efficiency and greater speed to market.

Portfolio changes and rebalance instructions are implemented automatically, ensuring client portfolios are kept up to date, without the need for additional paperwork, ROAs or client signatures, which may save you and your clients time and reduce unnecessary and costly delays of implementation.

Platform providers offer varied degrees of functionality which can allow you to tailor outcomes to best suit your clients’ circumstances. Functionality may allow you to customise individual portfolio holdings, model (pre-trade) and optimise tax outcomes to minimise CGT obligations, and net trades to reduce transaction costs.