We’re committed to empowering you to deliver innovative solutions that unlock new opportunities for your clients. Since its introduction, we’ve been collaborating with advisers to deliver meaningful enhancements to the way you set up new SMSF Access accounts, and your client’s experience . Some of the key changes for improving the way you and your clients interact with SMSF Access include:

A simplified application and set up process

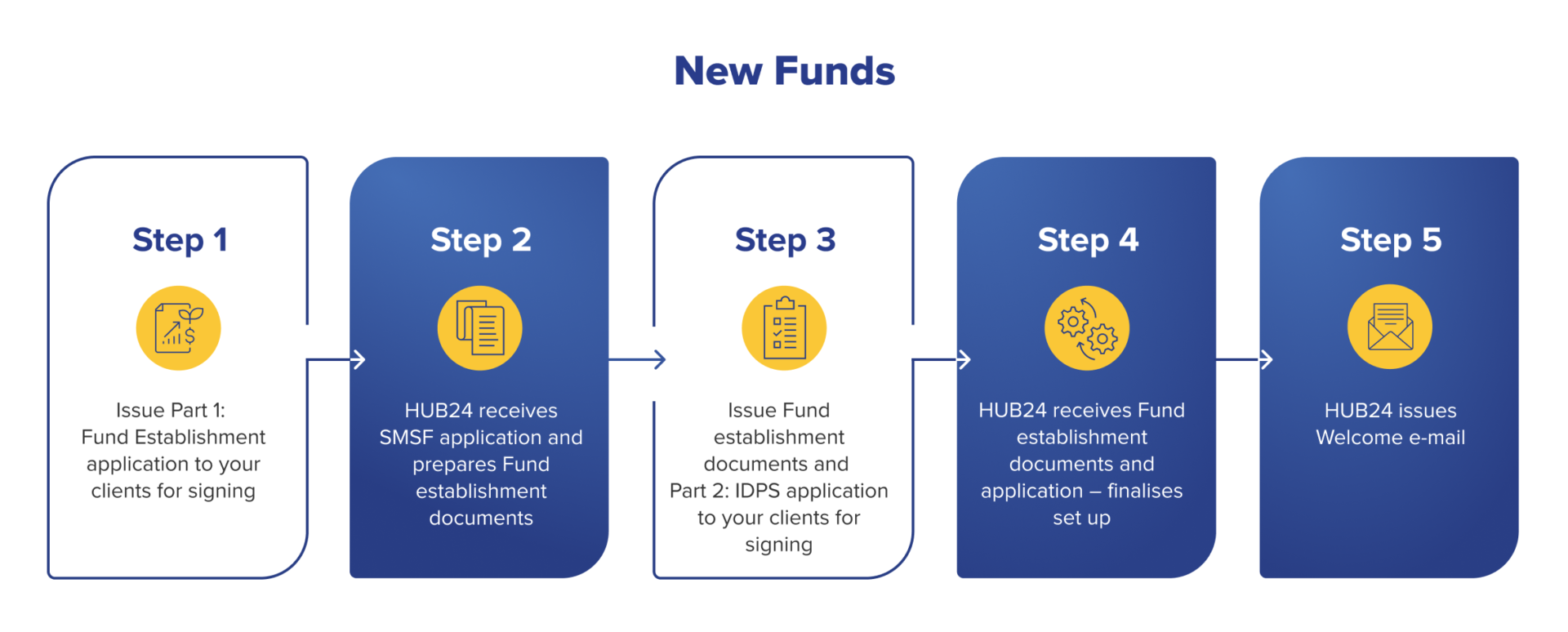

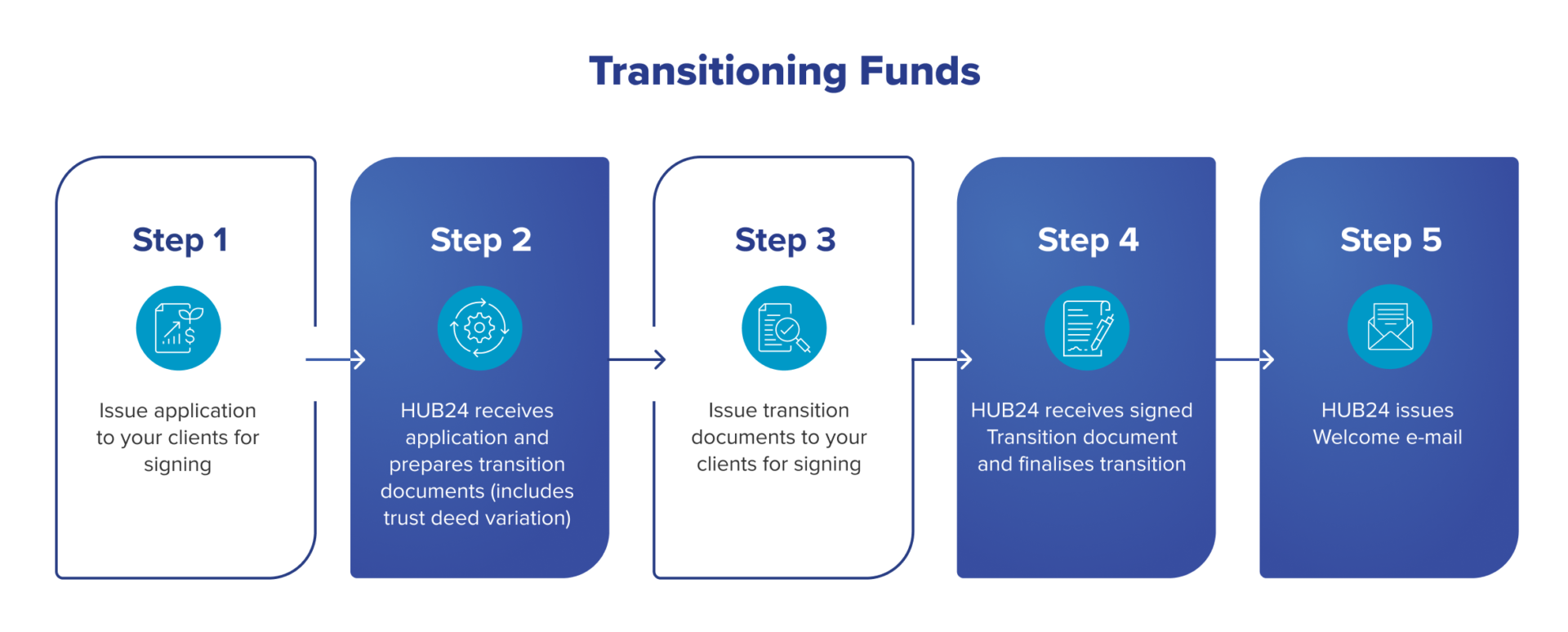

We’ve improved the client experience with a streamlined SMSF Access application process, significantly reducing the complexity and number of touchpoints for both new and transitioning funds. Client involvement has now been reduced to two steps for the establishment of a new SMSF Access fund.

Faster access to Super Guarantee (SG) contributions through streamlined EFT processing

You and your clients can now take advantage of faster access to SG contributions, once they are received by us, through streamlined processing with unique EFT Payment details, which include a specific BSB and account number for all SMSF Access funds.

We also provide access to an Electronic Service Address (ESA) Notification Letter on AdviserHUB and InvestorHUB to enable your clients to give this information to their employer. The ESA Notification Letter can be accessed via Account Menu > eStatements > ESA Notification Letter.

Expedite rollovers with the introduction of a new Cash Statement (Rollovers) report

As you’re aware, many paying institutions require evidence that a bank account is attached to an SMSF. To satisfy this requirement on behalf of your SMSF Access clients, we’ve introduced a new Cash Statement (Rollovers) report, containing the SMSF name, the BSB and unique account number, that needs to be provided to paying institutions. This report can be accessed by you to support any requests for a bank statement prior to rollovers being approved/paid into HUB24 Invest for SMSF Access investors. The Cash Statement (Rollovers) report is available on AdviserHUB > Account reports.

Claim Reduced Input Tax Credit (RITC) on Advice fees

SMSF Access funds will now be registered for GST, enabling all Trustees to be eligible to claim RITC on Advice fees via the SMSF Access Administration Service. This feature is only available to SMSF Access investors and is not available to standard IDPS investors. No action is required by you or your clients – we will register each SMSF for GST and lodge annual BAS returns as required on behalf of each Trustee. All GST refunds will be paid into the SMSF Access fund’s HUB24 Invest cash account once this has been received from the Australian Tax Office (ATO) each year.

Resources to support conversations with your clients

We’ve developed a suite of informative fact sheets to guide you and your clients through key SMSF Access processes.

Comprehensive SMSF Fact Sheets

We’re here to help

If you’re interested to learn more about how these new SMSF Access enhancements can benefit your business and clients, get in touch with us today.

Visit our Recent Platform Enhancements page.

Visit our HUB24 SMSF Access page.