Together we’re creating Australia’s Best Platform

Empowering better financial futures, together.

Great advice combined with market-leading platform functionality can add value for clients. It’s what we call ‘platform alpha’. Our innovative managed portfolio functionality and market-leading platform features designed to drive efficiencies in your business, are just a couple of reasons why advisers rated us number one.1

Save time with interactive client presentations at your fingertips

HUB24 Present brings together the portfolio data advisers need to provide interactive and downloadable client presentations on the HUB24 platform, all with a few clicks.

HUB24 Present gives advisers the tools they need to build engagement and understanding by telling clients their investment story in a simple and compelling way.

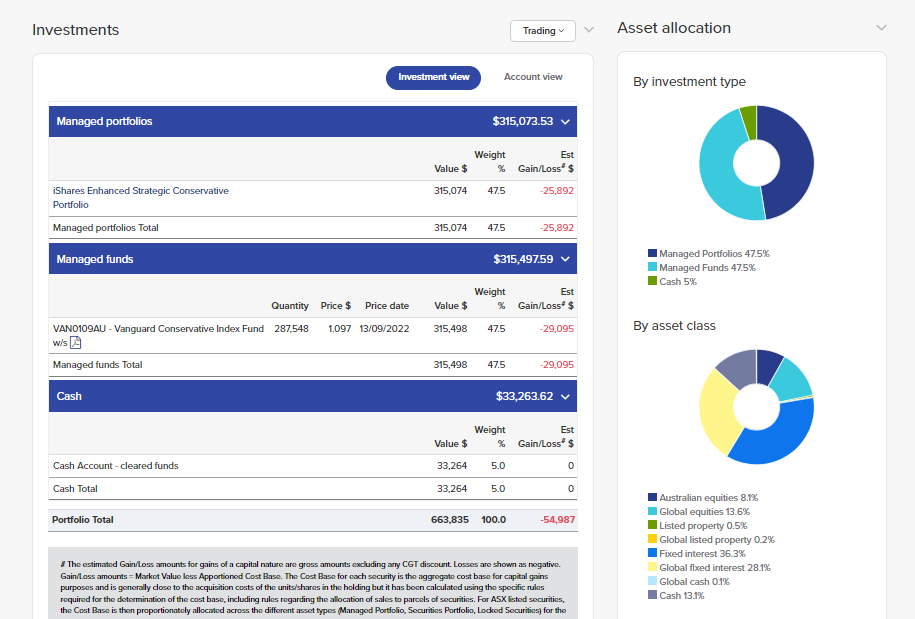

Broad investment choice

Advisers have given us top marks for Overall Best Investment Options.2 Our wrap investment menu offers a broad range of managed portfolios, managed funds, ASX listed securities, international listed securities, term deposits, annuities and more – our investment menus are constantly evolving to ensure we meet the changing needs of your clients. We understand that every client is different, so we’ve created three investment menus to choose from.

Innovative platform functionality adds value

We know that great advice combined with enhanced platform functionality can add value to a clients’ portfolio – this is what we call ‘platform alpha’. Whether it’s our leading tax optimisation capabilities giving you the ability to manage capital gains tax (CGT) implications when rebalancing, trade netting capabilities to reduce unnecessary trading costs, or our stock substitution functionality to tailor your clients’ portfolios based on their needs, we’re empowering you to deliver real value for your clients.3

Innovative managed portfolio functionality

Making things easy for you and your clients is at the core of everything we do. That’s why our managed portfolio solution can help reduce the administration and compliance burden of managing multiple clients and drive better investment outcomes for their portfolios.

Flexibility powered by technology

We’ve purpose-built our platform functionality to drive efficiencies for your business and your clients, such as online account opening with straight-through processing (STP), innovative digital advice fee consent tools and our flexible ROA generator.

More power to support client needs across their wealth journey

HUB24 Discover provides a cost-effective investment option for your clients with simple investment needs, giving you the flexibility to meet more client needs throughout their wealth accumulation and retirement journey, all in one place.

HUB24 Discover provides a streamlined selection of managed portfolios by leading portfolio managers, with a simple, cost-effective fee structure, all on our award-winning HUB24 platform.

As your clients’ needs evolve, they can transition to our Core and Choice menus and access the benefits of a wider range of investment options while retaining the same account and underlying investments without incurring significant costs or CGT.†

† Where portfolios are different, part of the portfolio may trigger some capital gains tax (CGT) and other costs to realign the portfolio to the chosen option.

How are we innovating to grow the SMSF market?

HUB24 SMSF Access is designed to meet the needs of clients who want to experience the benefits of their own SMSF without the associated costs and administration complexity of establishing and managing a traditional SMSF.

By establishing an SMSF earlier, clients can take control of their super, and benefit from the portability, flexibility and transparency they want. They can also incur a lower CGT impact given their lower balance, compared to if they established their fund down the track, when their balance is higher.

And as their investment needs become more complex, and their balance grows, clients can easily move to a traditional self-managed super fund administration service, without the need to sell down any investments.

Delivering value for your clients

With a broad range of investment and insurance options and innovative managed portfolio functionality, you can tailor solutions to meet your clients’ needs and deliver real value on our award-winning platform.4

- Online account opening with digital advice fee consent and straight-through processing

- Flexible approach to accepting digital or wet signatures

- Automatic cash management tools

- In-specie capability into IDPS

- Capital Gains Tax calculator to model potential tax outcomes before trades are placed

- Three choices for tax optimisation – FIFO, min gain or max gain

- Rebalancing using an aggregate trade processor

- Personalised ROA generation for individual and bulk trading, plus model portfolios

- Ability to exclude and/or make substitutions of assets with a Managed Portfolio

Innovative managed portfolios

Innovative managed portfolios empowering advisers and delivering value for clients.

Does your platform create value for your clients?

We’ve known for some time that good advice combined with enhanced platform functionality can add value for your clients, but now we’ve proved it in this two part series with Milliman Australia.

“Delivering Platform Alpha” provides case studies and examples of how enhanced platform functionality on HUB24 can add value for clients. “The cost of delay” illustrates the impact of delaying asset allocation changes and portfolio rebalancing.

Related Insights

Trust, transparency, and technology can work together to provide a strong framework from which an advice practice can address changes

Trust, transparency, and technology can work together to provide a strong framework from which an advice practice can address changes

We’ve known for some time that good advice combined with enhanced platform functionality can add value for your clients, but

We’ve known for some time that good advice combined with enhanced platform functionality can add value for your clients, but

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

1 HUB24 was rated Best Overall Platform by advisers in the 2024 Adviser Ratings Australian Financial Advice Landscape Report.

2 HUB24 was rated Best Overall Investment Choice by advisers in the 2022 Adviser Ratings Australian Financial Advice Landscape Report.

3 Advisers rated us #1 for tax optimisation tools in the 2023 Investment Trends Adviser Technology Needs Report.

4 HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.