Managed portfolios on HUB24

Innovation that keeps delivering value for you and your clients with award-winning managed portfolio capabilities.

Managed portfolios on HUB24

Innovation that keeps delivering value for you and your clients with award-winning managed portfolio capabilities.

What are managed portfolios?

Managed portfolios are investments owned by your clients but managed by professional investment managers. The investment managers oversee the portfolios and make investment decisions based on your clients’ financial goals and risk tolerance.

Managed portfolios are investments owned by your clients but managed by professional investment managers. The investment managers oversee the portfolios and make investment decisions based on your clients’ financial goals and risk tolerance.

Why choose managed portfolios on HUB24?

Benefits of managed portfolios on HUB24 for your clients

Our market-leading managed portfolio functionality allows you to optimise tax outcomes at both an account level for HUB24 Invest and HUB24 Super (assets held directly such as managed funds, Australian and International listed securities and other separately held assets) as well as assets held at the managed portfolio level. You can estimate potential Capital Gains Tax (CGT) impacts as a result of delays from the timing of switches and transactions, and model consequences of various tax treatments (FIFO, Min Gain, Max Gain) to select the most appropriate parcels to be sold.1

Are you looking to tailor your clients’ investments to meet their individual needs? Our flexible client-directed customisation capability enables you to exclude specific investments both inside and outside of your clients’ managed portfolios. You can tailor and implement investment strategies to help your clients navigate ethical, social, or other important factors (such as employment-related restrictions on owning specific securities).

We know it’s important to offer you and your clients choice, so you can select the right investments to meet your clients’ needs. We offer over 250 managed portfolios on our public menu with a range of single sector and diversified strategies to choose from.2 Managed portfolios can be made up of any mix of cash, direct securities (global and domestic), ETFs, LICs, managed funds, other managed portfolios and more. With HUB24, your clients can hold multiple managed portfolios alongside other investments, all within the one account.

Instructions from portfolio managers are implemented automatically, ensuring client accounts are kept up to date, taking full advantage of the latest expert investment management.

Benefits of managed portfolios on HUB24 for your business

65% of advisers who use managed portfolios believe that they’ve enhanced their focus on advice. These advisers also believe that using managed portfolios has given them greater focus on clients’ financial and lifestyle goals, distanced their value proposition from investment returns and allowed them to place greater emphasis on educating clients.3

54% of surveyed advisers who use managed portfolios said that implementing managed portfolios resulted in an improved client experience.3

Managed portfolio changes automatically flow through to your client’s account. This reduces the need to complete advice paperwork whenever a rebalance or portfolio change is made, giving you more time to focus on your clients’ goals.

Clients in the same managed portfolio share the same investment outcomes, meaning you can stay across managed portfolio changes and performance across your client base.

Investment managers on HUB24

We provide access to over 250 professionally managed portfolios, spanning both Australian and international markets. Our diverse selection of expert investment managers ensures that you can tailor portfolios to meet the unique needs and goals of your clients, offering a broad range of strategies across asset classes.

Supported by our innovative technology, through our constant commitment to innovation that delivers, we’re empowering our investment managers to deliver and enhance their portfolio strategies, providing the precision and expertise that advisers rely on for optimal client outcomes.

Learn more about managed portfolios on HUB24

Earn CPD points with our Managed Portfolio Academy

Our CPD-accredited Managed Portfolio Academy is designed for practice principals, advisers, and support staff to deepen their understanding of how managed portfolios can deliver real client value and drive business efficiencies.

Our four-module academy provides practical insights into the benefits of professional portfolio management, offering scalable and cost-effective solutions for your clients. Whether you’re looking to enhance client outcomes or improve operational efficiency, our Managed Portfolio Academy equips you with the tools and knowledge to make the most of our innovative solutions.

Managed portfolio resources for you and your clients

We know how important it is for you to have the right tools to help you explain managed portfolios to your clients. That’s why we’ve prepared these educational guides, case studies and insights.

An adviser’s guide to managed portfolios

A practice guide to managed portfolios

An investor’s guide to managed portfolios

Getting the most out of managed portfolios

Enabling accessible advice with managed portfolios

Additional resources

- HUB24 Managed Portfolio Service TMD – 10 November 2023 View

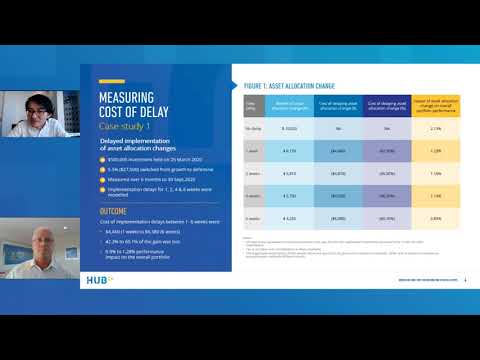

- Platform Alpha Series: Measuring the Cost of Delay Download

- Whitepaper: Delivering Platform Alpha Download

- An Investor’s Guide to Managed Portfolios Download

- A Practice Guide to Managed Portfolios Download

- An Adviser’s Guide to Managed Portfolios View

Frequently asked questions

A managed portfolio, also known as a managed account or separately managed account (SMA), is simply a collection of investments, generally held through a non-unitised registered managed investment scheme that are managed on your client’s behalf by a professional portfolio manager.

They can be held within a superannuation account or as part of an investment account.

When your clients invest in a managed portfolio through their investment account, they typically own a beneficial interest in all the underlying assets (whether they be a direct listed securities or units of underlying managed funds). When your clients invest in a managed portfolio through their superannuation account, the Trustee generally retains the beneficial interest of the underlying assets on their behalf. Just like the direct investments held in either you clients’ superannuation or investment accounts, the legal interest in the underlying assets is held by the appointed custodian or sub-custodians.

Webinars

Watch the latest in our Platform Alpha series where HUB24’s Head of Managed Portfolios, Brett Mennie, and Milliman Australia’s Principal

Watch the latest in our Platform Alpha series where HUB24’s Head of Managed Portfolios, Brett Mennie, and Milliman Australia’s Principal

This panel discussion includes Empower Business Advisory Founder and former Investment Trends research director, Recep III Peker who provides insights

This panel discussion includes Empower Business Advisory Founder and former Investment Trends research director, Recep III Peker who provides insights

How could using managed portfolios impact your clients’ perceived notions of value? Watch our webinar with State Street’s Global Head

How could using managed portfolios impact your clients’ perceived notions of value? Watch our webinar with State Street’s Global Head

HUB24’s Head of Managed Portfolios Brett Mennie discusses with Forte Asset Solutions’ Managing Director Steve Prendeville the positive impact of

HUB24’s Head of Managed Portfolios Brett Mennie discusses with Forte Asset Solutions’ Managing Director Steve Prendeville the positive impact of

Insights

For more than 30 years, leading financial services provider Australian Financial Advisers (AFA) invested with a mainstream managed fund provider

For more than 30 years, leading financial services provider Australian Financial Advisers (AFA) invested with a mainstream managed fund provider

By: Brett Mennie, Head of Managed Portfolios, HUB24 At their core, supermarkets and distribution platforms are very similar, where managed

By: Brett Mennie, Head of Managed Portfolios, HUB24 At their core, supermarkets and distribution platforms are very similar, where managed

The introduction of managed portfolios is assisting advisers meet Best Interests Duty and delivering customer benefits such as tax optimisation

The introduction of managed portfolios is assisting advisers meet Best Interests Duty and delivering customer benefits such as tax optimisation

Let’s talk about how our market-leading platform can help you.^

Submit your details and one of our team will be in touch.

^ HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

1 HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

2 Advisers rated us #1 for tax optimisation tools in Investment Trends 2021 Adviser Technology Needs Report.

3 Investment Trends January 2022 Managed Accounts Report.

Target Market Determination

A target market determination (TMD) has been prepared which considers the design of this product, including its key attributes, and describes the class of consumer for whom this product is likely to be consistent with based on their likely objectives, financial situations and needs. A copy of the TMD for this product can be obtained from your financial adviser or is available on our website at www.hub24.com.au.