HUB24 SMSF Access

Innovation to grow the SMSF Market

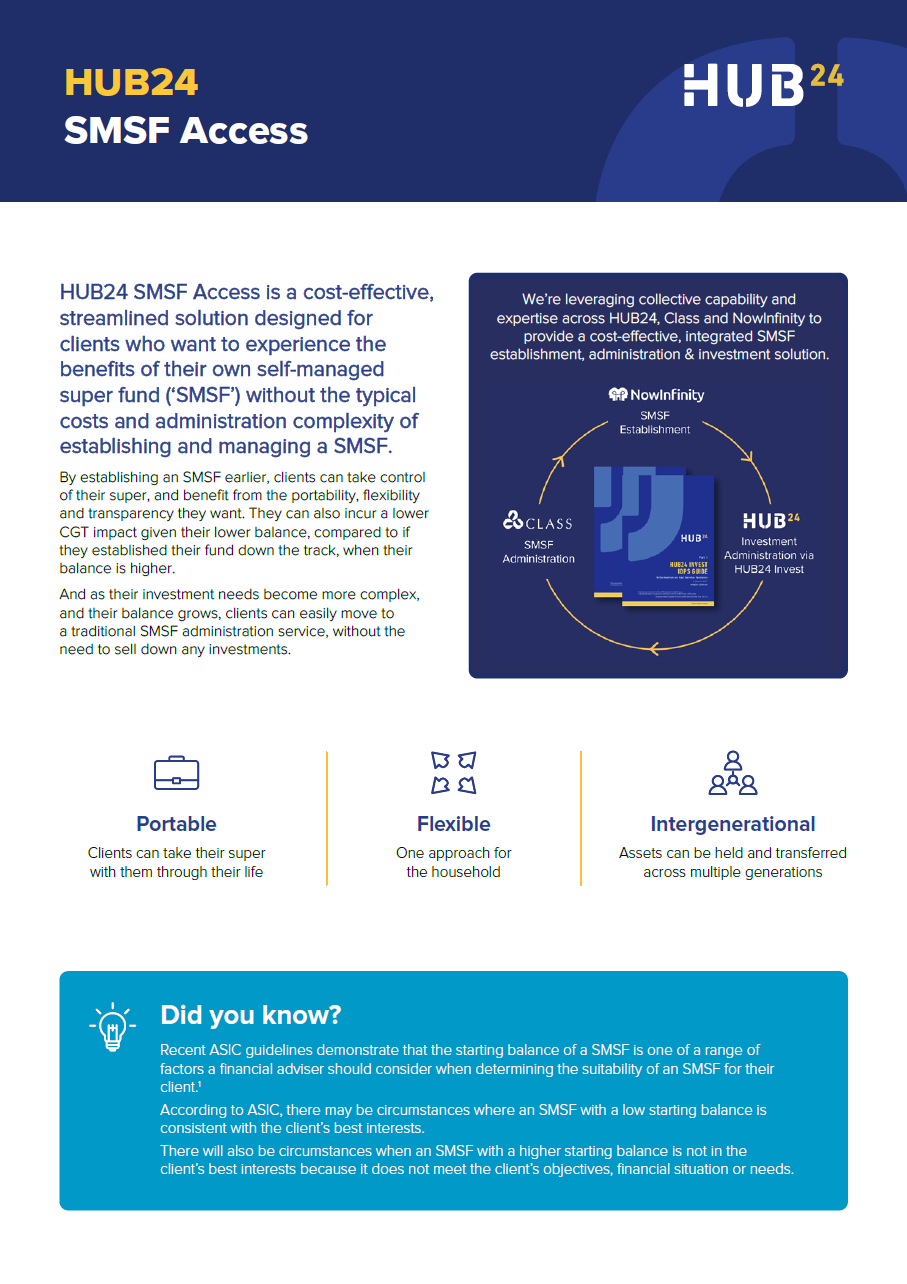

HUB24 SMSF Access is a cost-effective solution designed to meet the needs of clients who want to experience the benefits of their own SMSF without the associated costs and administration complexity of establishing and managing a traditional SMSF.

By establishing an SMSF earlier, clients can take control of their super, and benefit from the portability, flexibility and transparency they want. They can also incur a lower CGT impact given their lower balance, compared to if they established their fund down the track, when their balance is higher.

And as their investment needs become more complex, and their balance grows, clients can easily move to a traditional self-managed super fund administration service, without the need to sell down any investments.

Introducing HUB24 SMSF Access

We’re leveraging collective capability and expertise across HUB24, Class and NowInfinity to provide a cost-effective, integrated SMSF establishment, administration & investment solution.

We’re committed to empowering you to deliver innovative solutions that unlock new opportunities for your clients. It’s by working with advisers like you that we’re able to continuously improve our market-leading platform, and our approach to SMSF Access is no different.

Comprehensive HUB24 SMSF Access Fact Sheets

Insights

There was once a time when really sophisticated financial advice strategies could involve super being transferred from one generation to

There was once a time when really sophisticated financial advice strategies could involve super being transferred from one generation to

A summary of what you’ll read about in this guide: Introduction For the 2023/24 income year the cap on ‘concessional

A summary of what you’ll read about in this guide: Introduction For the 2023/24 income year the cap on ‘concessional

This article by Meg Heffron is written for clients. You can download a copy of the article to share with

This article by Meg Heffron is written for clients. You can download a copy of the article to share with

In this webinar, Greg Hansen (Executive Group Strategy at HUB24), Jo Hurley (General Manager Growth at Class), Meg Heffron (Managing

In this webinar, Greg Hansen (Executive Group Strategy at HUB24), Jo Hurley (General Manager Growth at Class), Meg Heffron (Managing

A recent ASIC Information Sheet release provided further guidance on giving self managed super fund advice. Whist this provides further

A recent ASIC Information Sheet release provided further guidance on giving self managed super fund advice. Whist this provides further

New research Dispelling the $500K myth

Research from University of Adelaide found no material differences in performance patterns for SMSFs between $200K and $500K, so the notion that smaller SMSFs in this range deliver materially lower net investment returns, on average, than larger SMSFs in this range, is not supported by the research results.

ASIC removes $500k guidance on minimum starting balance guidelines for SMSF

Recent ASIC guidelines demonstrate that the starting balance of a SMSF is one of a range of factors a financial adviser should consider when determining the suitability of an SMSF for their client.

According to ASIC, there may be circumstances where an SMSF with a low starting balance is consistent with the client’s best interests.

HUB24 Invest Disclosure Documents

(Including HUB24 SMSF Access)

- HUB24 Invest (Including HUB24 SMSF Access) IDPS Guide – Parts I, II and III View

- HUB24 SMSF Establishment Service Guide Download

- HUB24 Invest (Including HUB24 SMSF Access) Target Market Determination – 10 November 2023 View

- HUB24 Invest Individual Insurance Options View

- Investment booklet – Core menu View

- Investment booklet – Choice menu View

HUB24 Invest – Other Important Information

- HUB24 SMSF Access Tax Agent Services Guide Download

- HUB24 Invest SMSF Access Material Event Notice – 29 April 2024 Download

- HUB24 SMSF Access Rollover IN Form Download

- Voting Policy Download

- Financial Sevices Guide (FSG) View

- Cash account information View

- International Listed Securities Guide Download

Important Updates to Disclosure Documents

More information

The ATO has prepared a series of short animated videos covering key responsibilities and considerations for SMSF trustees to help them manage their fund and meet their obligations.

Australia’s best platform delivering choice & value for your SMSF clients1,2

Whether it’s our leading tax optimisation capabilities giving you the ability to manage capital gains tax (CGT) implications when rebalancing, trade netting capabilities to reduce unnecessary trading costs, or our stock substitution functionality to tailor your clients’ portfolios based on their needs, we’re empowering you to deliver real value for your clients.3

When used in combination with ESG Ratings on HUB24, you can construct a more personal and tailored investment approach to meet your clients’ individual SMSF investment needs.

Our broad investment menu delivers choice for SMSF clients

We’re committed to offering your clients choice and flexibility in how they invest, so it’s no wonder we’ve been rated #1 for the range of investments offered on our platform.2

Our wrap investment menu offers a broad range of ESG focused investments, including managed funds, Australian and US listed ETFs and managed portfolios.

New ESG ratings from Morningstar and RIAA

We’ve collaborated with Morningstar and Responsible Investment Association Australasia (RIAA) to bring you new ESG Ratings on HUB24.

Access the Morningstar Sustainalytics ratings system, which scores selected funds and Australian listed securities on a sliding scale of ESG risk factors, and understand if a managed fund has been certified by RIAA as a quality, true-to-label responsible investment product that meets RIAA’s Responsible Investment Standard.

1 HUB24 won Best Platform Overall, Best Platform Managed Accounts Functionality, Best in Product Offering, Best in Decision Support Tools, Best in Online Business Management and Most Improved in the 2024 Investment Trends Platform Competitive Analysis and Benchmarking Report.

2 HUB24 was rated Best Platform Overall, Best Client Experience, Best Adviser Experience, Best Ease of Onboarding, Best Overall Functionality, Best Overall Investment Options, Best BDM Support and Best Online/ Call Centre Support in the 2024 Australian Financial Advice Landscape Report.

3 Advisers rated us #1 for tax optimisation tools in the 2021 Investment Trends Adviser Technology Needs Report.